How many shares should I buy? This question is more complex than most people think. Although there is no limit on the number of shares you may purchase in a company’s stock, there could be restrictions or rules that might restrict your ability to buy as many shares as possible.

In this article, we are going to discuss THE FOLLOWING TOPICS:

- What are shares?

- Types of shares

- How many shares should I buy?

- Are there limits to stock purchases?

What are shares?

Stock shares are a fraction of the ownership of the company that issued them. Investors can earn capital appreciation or dividend pay-outs by owning shares or multiple shares. As shareholders, they can influence the company’s decisions by voting.

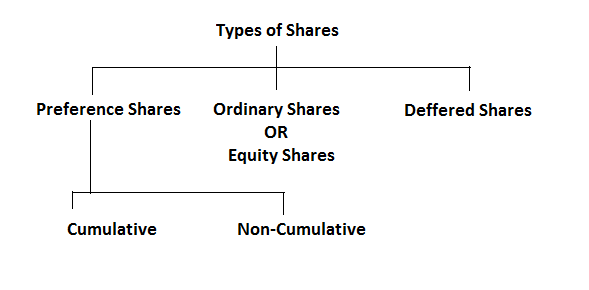

Types of shares

These are the five major types of shares:

- Ordinary shares are the most popular type of shares. They are standard shares without any restrictions or rights. These shares have the greatest potential for financial gains but also carry the highest risk. They have voting rights but are not eligible to receive any compensation if the company is wound down.

- Ordinary shares that are not voting but have no voting rights have the same conditions as common shares. In some instances, shareholders may be eligible for voting rights or may not have any voting rights.

- Preference shares usually have a right that grants the preferential holder treatment in receiving annual dividends. These shares are entitled to a fixed dividend. This means that shareholders would not be able to benefit from an increase of the business’ profits. If the company is in serious financial trouble, they usually have rights to their dividends before ordinary shareholders. Preference shares do not have voting rights.

- Cumulative preference shares allow holders to carry forward any dividends not paid in a given year. If the company is able to distribute profits, dividends on cumulative preference shares must be paid.

- The agreement to redeemable shares allows the company to repurchase them at a later date. This can be at a fixed time or at the business’s choice. So a company cannot issue redeemable shares only. They must also issue non-redeemable shares.

Most companies use ordinary shares. However, it’s possible to issue multiple types of share classes to increase shareholder voting, capital rights, and dividends.

How many shares should I buy?

The answer is not definitive. It all depends on your individual situation.

- How much money do you need to invest?

- What are your brokerage fees?

- Whether diversification is necessary for your investment portfolio.

It is easy to calculate the number of shares that you can purchase with the money you have.

Find the stock’s share price. Your broker can provide a quote. Divide the current share price by the amount you want to invest. Start small if you are just beginning as an investor.

Financial experts recommend that you try 10+ stocks to increase your savings. To be well-diversified, investors who have a lot to invest may choose to purchase more than 30 stocks.

Diversifying your portfolio should be a priority for new investors. To diversify your portfolio, you can buy different stocks and then add shares. It is essential only to buy one share in a high-quality company rather than multiple shares in a low-performing company.

Diversifying your portfolio is the first step. You won’t have much money to invest when you are just starting. Invest in the companies that interest you and buy one share.

As you get more money, try to keep your portfolio diversified. It is not a good idea to have one company holding too much of your portfolio. Some people limit their top holdings to between 5-10% of their portfolio.

You can add companies to your portfolio as you gain experience. Continue adding shares if you are satisfied with your level of diversification.

Are There Limits to Stock Purchases?

People often ask about company shares and whether there is a limit on how many they can buy. A company cannot issue unlimited shares so there will be a limit on the number of shares that can be purchased.

A company will issue a limited number of shares when it makes its initial public offering. After all shares have been sold, the company will issue a set number of shares. You would then need to wait for a secondary offering to purchase additional shares.

Although it is possible to buy all shares of a company, the increase in demand will most likely cause the share price to rise. To avoid a sudden price increase, competitive investors tend to buy shares incrementally. Once they own five percent of the voting shares in a company, investors must file a report to the Securities and Exchange Commission.

There are many factors to consider when determining how many shares you can buy in a company.

- How much of a company’s shares are publicly traded?

- The price of each share.

- If your purchase triggers reporting requirements.

If you don’t have much money, you can purchase penny shares but still want to play the stock market. Penny shares are a good option for first-time investors, but there are risks involved, even though they have a low price.

There is a limit on the number of penny shares that you can purchase. The company’s share count determines this. You should thoroughly research any company that offers penny shares before you are buying large amounts.

One of the biggest issues with penny shares is their difficulty in trading. It may be difficult to sell penny shares after you have purchased them. It may be difficult to find information about the company that is offering the shares. This can make it difficult to decide whether investing in a company is wise.