To invest in yourself is the smartest thing you can make. It will not only make your life better, but it will also improve the lives of those around you.

Investing isn’t only for grown-ups or “rich and famous”.

Children or adolescens can easily open a brokerage account with the help of their parents.

Parents are encouraged to open accounts for their children and start learning the basic principles of investing.

It is certain that if you acquire stocks as a child your investments will at least double until the age you become an adolescence.

In this article we are discussing the subject how old do you have to be to buy stocks by giving answers to the following questions:

- What is investing?

- How old do you have to be to buy stocks?

- Traditional brokerage accounts

- Why buy stocks for kids?

What is investing?

Investing refers to the purchase of assets that increase in value over time and return income in the form of either capital gains or income payments.

The most popular financial assets are stocks (or equities), bonds, mutual funds, debentures, ETFs, REITs, currencies and cryptos.

A capital gain occurs when you sell an asset for more than you paid for it. For example if you paid $100 to acquire an equity and after one year you sold it for $120 then your capital gains are 20%.

Income payments or dividends is when the company distributes a portion of its earnings to its shareholders as a bonus for their trust.

How old do you have to be to buy stocks?

To open a brokerage account your must be an adult.

In the USA some states don’t allow people to invest until they are 21.

Young people looking to grow their wealth must find other ways to invest.

Traditional Brokerage Account

Although children cannot open independently a brokerage accounts there are still the following options:

- Custodian brokerage account

- 529 plan

- Parent’s brokerage account

- Custodian IRA

Custodial brokerage account

A custodian brokerage account is perhaps the most popular option for children to invest.

Through this account children can invest money in stocks or other financial assets

The money in an account is the child’s property, regardless of who manages it and who contributes. These contributions are irrevocable gifts that parents and other adults cannot take back.

When the child turns 18 or 21, they can take complete control of the account, and can use it for any purpose.

529 plan

A 529 plan is an investment account that helps you save money for your education.

There are two types of these accounts.

One is a prepaid college plan that allows parents to lock in college costs and pay upfront. Parents can also invest in college savings plans to help grow their funds for their child’s education.

Family-friendly 529 plans offer tax benefits.

The account’s money grows tax-free. You don’t have to pay taxes if you withdraw the money for qualified education expenses.

529 plans have one drawback. The money is not intended to be used for college-related expenses. Your child can spend the money on any other than educational expenses, but they will have to pay taxes and a 10% penalty.

Parent’s brokerage account

Parents have the option to buy stocks for their children in their brokerage accounts.

The child does not have any ownership rights to the stock in this instance. While you might be thinking about their future when you purchase it, the stock is not in their name and they will have no legal claim to it once they turn 18.

Custodial IRA

A custodial individual retirement (IRA) is another option to invest for children. As long as the child earns income, families can either invest in a traditional IRA (or Roth IRA) account.

Although it may seem premature to save for retirement so young, it will give your child’s savings more time to grow and compound.

This type of account has a downside: the money is only intended for one purpose. The money could be more valuable for your children before they reach the golden years, as they will have to face large expenses all their lives.

You can open any type of brokerage account for your children, but you must first find a broker. No account fees or minimum deposit are required for the best investment accounts. This allows your children to invest with a very small amount.

Best Online Stock Brokers for Beginners of September 2021

| Logo | Broker | EconAlert Rating | Fees | Account Minimum | Visit Website |

|---|---|---|---|---|---|

| Soft Active Investing | 4.5 | $0 | $0 | Learn more |

| E*TRADE | 4.5 | $0 | $0 | Learn more |

| Interactive Brokers IBKR Lite | 5.0 | $0 | $0 | Learn more |

| TD Ameritrade | 5.0 | $0 | $0 | Learn more | |

| J.P. Morgan Self-Directed Investing | 4.0 | $0 | $0 | Learn more |

Why buy stocks for kids?

Make an investment in their success

Your child will likely face large expenses in his or her early adult years.

Young people start to incur costs in their late teens and early twenties. These include buying their first car, paying college tuition, moving to new places, getting married and purchasing homes.

Most of these items come at a steep price.

You can give your children a head start by buying stocks.

Let them take control of the funds

The assets of a custodial brokerage account that you purchase stocks for your child are all yours. The assets in the account belong to them, even if they don’t have any access.

Children can imagine all the things they could do with their money throughout their childhood. This gives children a sense that they are in control of their money and encourages them to dream big.

Teach them financial literacy

Basic financial concepts such as investing and saving are not taught in schools. Families are responsible for making sure that their children understand these topics.

You can open a custodial bank account for your child to teach them. Invite your child along to participate in investment decisions and watch as their money grows.

Things to Consider When Buying Stocks for Children

Taxes

You should be aware that investing for your children can have tax consequences.

Earnings from a custodial brokerage account are considered unearned income. Earnings up to $1,100 are exempt from tax. The $1,100 after that is exempted from tax will be subject to the child’s income tax rate. The parents’ rate will apply to the account if it earns more than 2200 dollars per year.

Account ownership

Every custodial brokerage account is managed by a custodian. They make all investment decisions but they do not own the money.

Everything in the account legally belongs to the child from the moment it is opened. You can’t get it back after you have contributed money. It is an irrevocable gift for the child.

The account is fully owned by the child once they reach adulthood. The account is no longer managed by the custodian. The child has full control and can use the money to any purpose.

Diversification

Diversifying your portfolio is an important step in investing. Diversification is the process of dividing your money among many assets in order to minimize risk.

You can diversify your portfolio in two ways. You can diversify across asset types. One example is to put some money in stocks and some in bonds. Your bond investments could still provide a return if the stock market crashes and vice versa.

Diversifying your portfolio by buying stock in different asset classes is another way to diversify. For example, you might buy stock in multiple companies or industries instead of investing your entire money in one company.

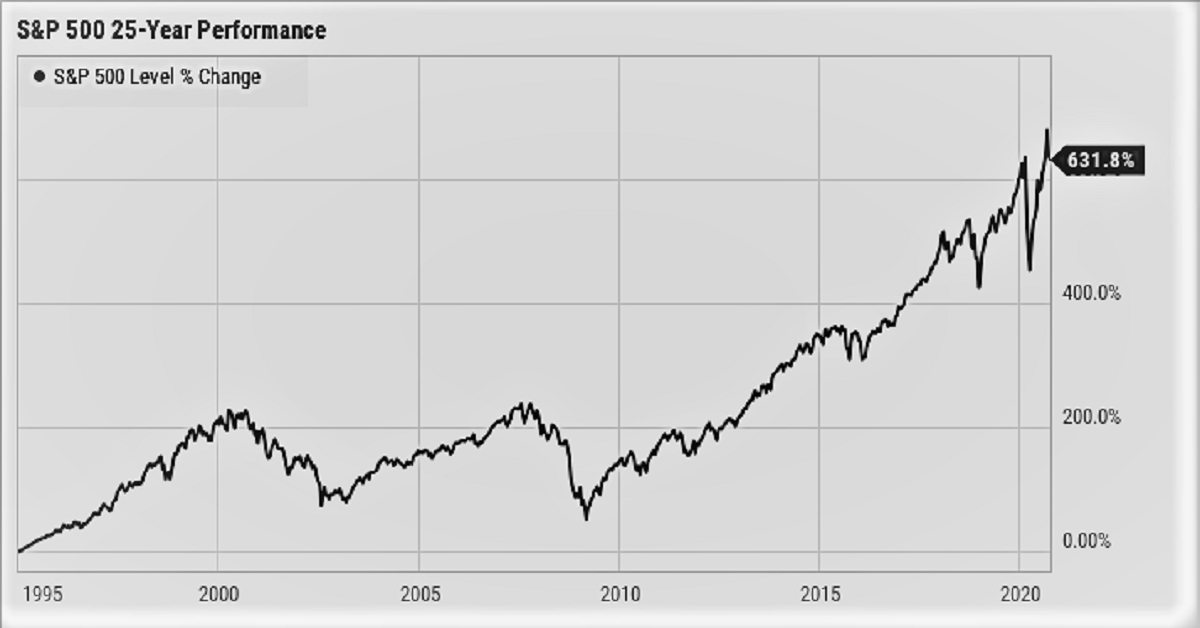

Time horizon

Your time horizon is an important factor when you begin investing. The time horizon is simply the amount of years you anticipate using the money you are investing.

You have a longer time horizon when you invest in a child’s early years. You have 18 years to save money if you invest before your child is born.

The Bottom Line

You can save for the future no matter your age with mutual funds and stocks.

A brokerage firm will usually require that someone is at least 18 years old to open a brokerage account or buy stocks. This doesn’t mean that you cannot invest for your children and make financial contributions to the future. It’s not just for adults. If you want your children to learn valuable lessons about investing and the power behind investment growth, opening a custodial brokerage account could be a great way to start.