Short selling or shorting is a trading strategy which allows an investor to profit from a fall in the price of any financial asset (e.g. stocks, bonds, commodities etc.).

Shorting was initially used as an “insurance” from financial downturns. Early in the 90s, Wall Street brokers put aside its hedging nature and started using shorting for speculation.

Shorting is the new trend in trading Bitcoins and Altcoins.

Although it is risky, it can generate signifcant profits if it is applied prudently.

In essence, this investment strategy allows you to profit from drops in the price of cryptos.

In this article we are going to discuss how to short Bitcoin by examinig the following topics:

- What is shorting?

- Why would you want to short Bitcoin?

- How to short Bitcoin?

What is shorting?

In few words, “shorting” is betting that an asset will fall.

In contrast, “going long” means betting that an asset will rise. The motive behind shorting is to make profits later by buying securities at a lower cost. Short covering is the act of buying securities at a lower price in order to make profit/loss.

Why Would You Want to Short Bitcoin?

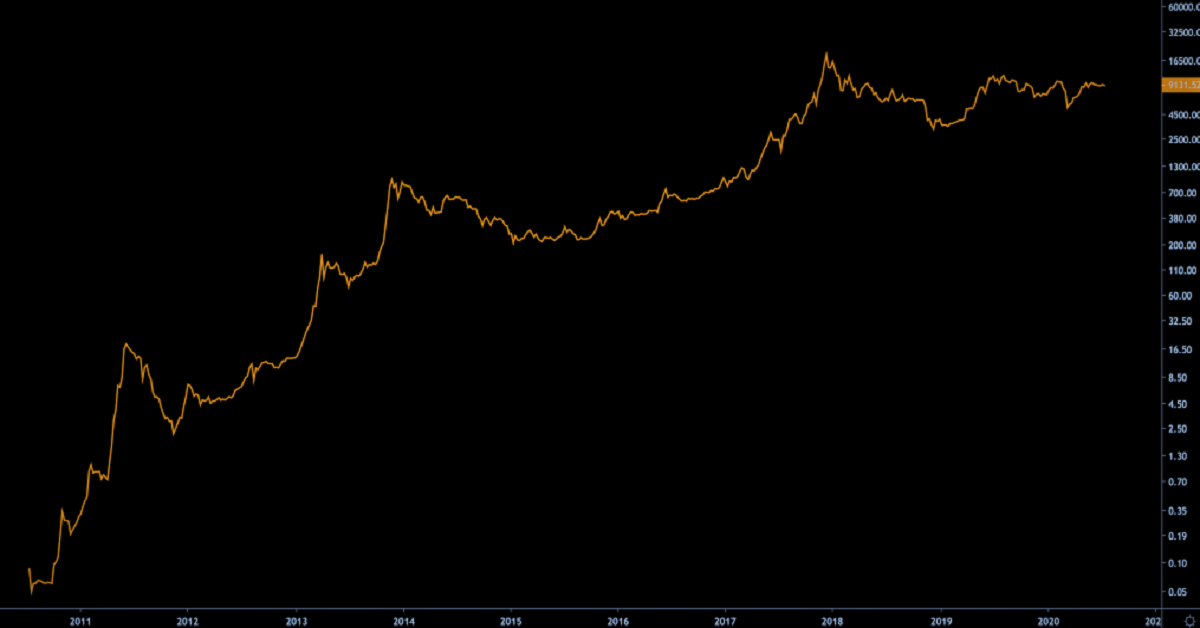

Although Bitcoin’s long-term price appreciation is obvious, there are many reasons to short it in the short-term.

Instead of letting your holdings slide when the market becomes pessimistic, you can protect your investments by using shorts.

How to Short Bitcoin?

You will need to contact a platform or trading agency in order to know how to short Bitcoins. The agency will then make the Bitcoins available for sale from their own stock, on the assumption that you will return them with an equal amount of Bitcoins in the future.

Short-selling is when the individual or firm that loaned you the Bitcoins can recall them at any time. They are usually required to give you a brief notice. You should read all rules and regulations regarding “covering” assets that you have shorted.

Markets fluctuating at such an rapid pace can cause costs to swing dramatically, putting you at great risk. If the lender calls the assets before they have the chance to fall, short selling can be particularly risky.

Stocks are a common subject for short selling. Most major trading platforms let you shorten stocks.

There are a variety of ways of how to short Bitcoin, here are the most popular once:

Short Sell CFDs

Contract for Differences (CFD) are a financial strategy that makes money on the basis of the difference in settlement prices. Bitcoin CFDs, which are basically bets on cryptocurrency’s prices, are very similar to Bitcoin futures. You are trading Bitcoin short if you buy a CFD that predicts Bitcoin’s price falling.

CFDs offer a longer settlement term than Bitcoin futures. They are not pre-set settlement dates like Bitcoin futures. Bitcoin CFDs don’t require physical delivery. You don’t have to pay custody fees. You can trade on certain Bitcoin CFD markets based on Bitcoin’s performance, relative to fiat currency, or another cryptocurrency.

Shorting via a Bitcoin Exchange

Other way of how to short Bitcoin is inverse exchange-traded derivatives.Those are bets on the price of an underlying asset falling. These products are similar to futures contracts. They can be used in conjunction with other derivatives to generate returns. You can bet on Bitcoin’s price falling using exchange-traded products such as the BetaPro Bitcoin Inverse ETF(BITI.TO), and 21Shares Short Bitcoin EPTP. These products are not available to residents of the United States.

Margin Trading

A cryptocurrency margin trading platform is one of the best ways to short Bitcoin. This type of trading is allowed by many exchanges and brokerages. Margin trades allow investors to borrow money from brokers in order to place trades. Margin can be leveraged or borrowed money. This can either increase profits or worsen losses. Margin trading is possible on many Bitcoin exchanges, including Binance and Kraken.

Futures Market

Like other assets, Bitcoin has a futures marketplace. A futures trade is where a buyer agrees that he will purchase security with a contract. This contract specifies when and how much the security will be sold. You are betting on the rise in the price of the security, which will ensure that you get a great deal later.

A futures contract that you sell suggests a bearish outlook and the prediction of a decline in Bitcoin’s price. How to short Bitcoin in this case is by buying futures contracts that bet on a lower cryptocurrency price.

Bitcoin futures trading began around the rise in cryptocurrency prices towards the end 2017. You can now access it on many platforms. Shorting Bitcoin futures can be done at the Chicago Mercantile Exchange, the largest derivatives trading platform in the world, as well as on cryptocurrency exchanges. You can trade or purchase Bitcoin futures on popular exchanges such as Kraken and BitMEX. They can also be found at popular brokerages like eToro or TD Ameritrade.

Binary Options Trading

Shorting Bitcoin is also possible with call and put options. You would execute a put order if you wanted to shorten the currency. This is usually done with an escrow company. This would mean that you want to be able sell the currency at the current price even if it drops in the future. Although binary options can be found on a variety of offshore exchanges and are relatively inexpensive, the risks and costs are very high. Binary options trading is more profitable than futures because you can choose not to sell your put options. Your losses will be limited to the amount you paid for the options. OKEx and Deribit are two of the most popular trading venues.

Get exposure to a pro trader’s strategy

One other option of how to short Bitcoin is now available. It might be worth considering if you aren’t sure if it’s possible to short the market but still want to have exposure to bitcoin’s volatility. Techemy Capital launched the Holistic Ethereum-BTC Portfolio via Enzyme Finance. The portfolio is actively traded and provides exposure to the price movement of Bitcoin and Ethereum. Your funds are yours to manage at all times.

Knowing When to Short

Shorting Bitcoin can be more difficult than other times. To put it another way, shorting Bitcoin against long term uptrends can be difficult. Bitcoin can slowly increase in value. In reverse, the digital asset can lose thousands of dollars in value in a matter of minutes. These examples show why it can be challenging for new investors to successfully shorten.

The market is still very young, so prices may fluctuate. Shorting bitcoin or any other asset or stock must be understood by traders. Therefore, traders should weigh the benefits and drawbacks of each trade. You can reduce risk by investing in smaller amounts. The cryptocurrency market has been relatively stable over the past few months. There have not been any major price swings.

Understanding the Market’s Mentality

You should also consider the mindset of other traders on the market. If you are short Bitcoin and the price suddenly rises quickly, you’ll need to quickly repurchase your assets. Every other investor will attempt to achieve the same goal, unfortunately.

Because a cryptocurrency like Bitcoin can experience huge price swings overnight, traditional shorting mechanisms require extra caution. A shorting contract that is started today could result in huge losses if the price rises.

The market value rises sharply due to the sudden rush to repurchase Bitcoin. This is what’s known as a “short squeeze”. This position can lead to losses. This scenario can be avoided by being vigilant with your market assessments.

The Best Crypto Exchanges of 2021

| Name | EconAlert Rating | Fees | Account Minimum | Visit Website |

|---|---|---|---|---|

| Binance.Us | 4.9 | 0.1% | $0 | Learn more |

| Coinbase | 4.5 | 1.99% | $0 | Learn more |

| Kraken | 4.8 | 0.26% | $0 | Learn more |

| Crypto.com | 4.7 | 0.40% | $0 | Learn more |

| Gemini | 4.5 | 0.35% | $0 | Learn more |

| Gate.io | 4.5 | 0.2% | $0 | Learn more |

| KuCoin | 4.1 | 0.1% | $0 | Learn more |

| Bitstamp | 3.4 | 0.5% | $0 | Learn more |

| Bittrex | 3.3 | 0.75% | $0 | Learn more |

| BitFlyer | 3.3 | 0.1% | $0 | Learn more |

The Bottom Line

Knowing how to short Bitcoin can be big advantage and great way to make some extra profits.You can make money by borrowing Bitcoins and selling them at a high price, then buying them back at a low price.

Shorting is also risky and is not recommended for traders just starting out due to the high risk involved. You should only short Bitcoin if you have the funds to do so. Keep up-to-date with all current events to anticipate any changes in the price direction.