Introduction

Hedge funds are well-known for taking on higher risk investments. They are popular with wealthy investors who are looking for greater returns and are willing take bigger bets.

“If you know how to invest in a hedge fund it can be extremely valuable. Hedge funds offer investors access to return drivers not found elsewhere in their portfolios.” says Chris Walvoord, Managing partner of Aon Chicago.

He explains that although the stock market’s overall level is the main driver for nearly all equity funds, many hedge funds try to minimize or hedge their exposure to it.

Many well-known hedge fund companies manage hundreds of millions of dollars. These include Bridgewater Associates and AQR Capital Management, J.P. Morgan Asset Management, Renaissance Technologies, and J.P. Morgan Asset Management.

Hedge funds are known for using leverage and investing in other asset classes, such as private companies or real estate.

In this article we are discussing how to invest a in hedge fund by analyzing the following topics:

- What is a hedge fund?

- Hedge Fund Fees

- Hedge Fund Minimum Investments

- Hedge Funds Lock-Up Periods

- Who can invest in Hedge Funds?

Finally, we are comparing similarities and differences between:

- Hedge Funds & Mutual Funds

What is a hedge fund?

Hedge funds pool money from investors to purchase securities and other investments. This sounds very similar to a mutual fund, exchange-traded funds (ETF), or other types of investments. Hedge funds don’t have the same restrictions as mutual funds. Hedge funds are more likely to use aggressive investment strategies like short-selling and leveraged, debt-based investing. They can also purchase assets that other funds cannot, such as real estate and art.

These strategies that hedge funds use are fraught with risk, according to Sarah Catherine Gutierrez (CFP), Aptus Financial CEO and certified financial planner (CFP).

She says that hedge funds are more risky investments as they often place bets on investments for short-term gains and outsized returns. This can include borrowing dollars. These bets could lose.

These riskier strategies are used by hedge funds to generate returns, regardless of market conditions. Investors who want to continue earning returns in bear markets will find this tactic appealing. There may also be glamour in being able to know how to invest in a hedge fund funds.

Some view hedge funds as an exclusive club for which you must be a member,” states Katie Brewer, CFP, president of Your Richest Life. Hedge funds have their benefits–higher returns–but also disadvantages like volatility, illiquidity and risk

Hedge Fund Fees

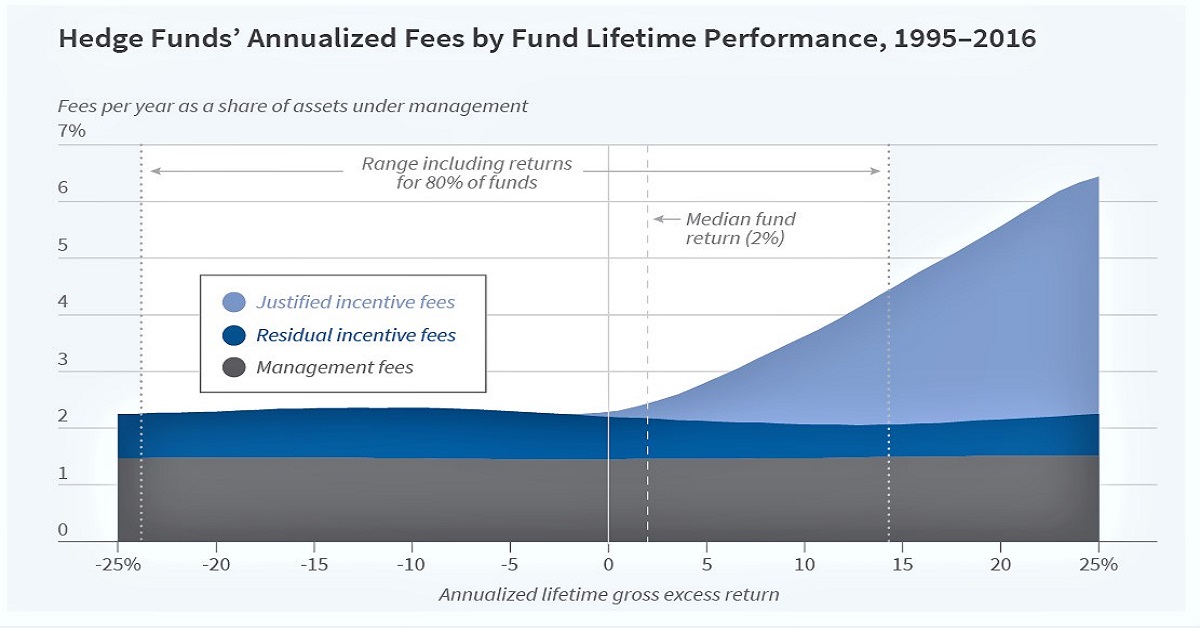

Before you decide to invest in a hedge fund, make sure you review the fees. Common fee structures for hedge funds are 2 and 20, which include a 2% management fee, and a 20% incentive/performance fee. With the 2 and 20 compensation structure, the 2% management fee is applied to all the assets that are under management while the 20% incentive/performance fee is charged on profits generated by the hedge fund, usually above a specific minimum threshold.

It is important to note that the 2% management fees are charged on all assets under management, regardless of how they perform under the manager.

Hedge Fund Minimum Investments

At their discretion, the individual or persons managing the fund can set the minimum investment for the hedge fund. The minimum investment amount for a hedge fund is limited by the number of investors that can be accepted. Therefore, it’s important to set a high minimum investment. New hedge funds are often required to invest between $100,000 and $500,000. Higher minimums are expected for established funds; $25,000,000 is not uncommon.

Investors who want to invest in a minimum amount or more than that stipulated over time could be granted a waiver by general partners.

Hedge Funds Have Lock-Up Periods

Hedge funds are different from stocks and exchange-traded funds in that investors must leave their money in the fund for a specified period before they can redeem it. This is also known as a lockup period, notice period, or restriction on redemptions. These details are provided in the legal documents.

Hedge funds invest often in real estate and mineral exploration rights, but they offer less liquidity than assets like stocks or ETFs.

Experts say that lock-up periods are a restriction on the investor’s ability to access those funds for a specific time. They can typically last at most a year.

These characteristics make it difficult for retail investors to invest in a hedge fund. They may not be able or able to pay high investment minimums, lock-up periods or take on higher levels of risk.

Who can invest in Hedge Funds?

Hedge funds carry higher risk than traditional investments. The U.S. Securities and Exchange Commission (SEC), has regulations regarding who can invest in them.

You must be an institutional investor such as a pension fund or an accredited investor to invest in hedge funds. Accredited investors must have a net worth at least $1,000,000, which does not include the value of their primary residence or an annual income of over $200,000 (or $300,000 if they are married).

This is a tiny fraction of the U.S. citizen population. The United States Census Bureau estimates that only 4% of households earn more than $300,000 to qualify for accredited investor status.

However, there are now more qualified applicants than originally intended.

Gutierrez says that the thresholds to be considered an accredited investor have not been updated since 1980s and are now used by many more people than previously thought. These numbers would be closer to net worths between $2.5 million and $500,000, or $500,000 in salaries if married. Hedge funds are not for the average investor.

This claim is supported by the SEC guidelines. In August 2020, provisions were made to allow investors who have advanced knowledge of investing, such as those with qualifying work experience or certain financial licences, to be accredited even if they lack the financial qualifications.

How to Invest in a Hedge Funds?

To invest in hedge funds, first research funds currently accepting new investors. Although there are many online tools to help you find potential hedge funds, a financial advisor is a better choice. After you have completed Form ADV and analyzed the fund managers, investment goals and other details, you will need to contact a hedge funds and request information about minimum investment requirements.

Also, you will need to prove that you are an accredited investor. There is no standard accreditation process or authority. Every fund uses its own procedures to determine your status. This could mean that you will need to disclose your income, assets and debts, and have them confirmed by licensed third parties such as a financial institution, investment advisor, or attorney.

How to Invest Like a Hedge Fund

You have several options to imitate hedge funds if you don’t meet the requirements of hedge fund firms or are not accredited investor.

Brewer says that you can find ETFs and mutual funds as well as funds of funds that follow similar strategies to hedge fund strategies like short-selling or leveraged investment. The Global X Guru (GURU) and a startup called Titan claim they follow the same strategies that select hedge funds.

To grow your wealth, you don’t have to invest in hedge fund funds. Broad market indices have historically outperformed hedge fund investments, so it may be better to invest in index funds. Remember this: If you are trying to build wealth, investing in index funds is best for the long-term. You can continue to invest in index funds for years even if the market is down, which is why hedge funds are so popular. This allows you to buy lower and get higher returns once the market recovers.

Hedge Funds vs. Mutual Funds

What is the difference between mutual funds and hedge funds? Which is more suitable for you? Understanding the basics will help you decide which mutual funds or hedge funds is best for you.

The Similarities

Hedge funds and mutual funds share a few commonalities:

- Pooled investments: Mutual funds and hedge funds both are examples of pooled investment. This means that assets consist money from multiple investors, which is consolidated into one portfolio.

- Diversification is when a fund invests in multiple securities. Mutual funds and hedge funds are usually diversified, but some funds focus on one type of security or sector.

- Professional portfolio management. Professional portfolio management. Investors who invest in mutual funds and hedge funds are not able to choose the securities they want to invest in. Instead, a fund manager makes that decision.

The Differences

Although both funds pool money from different investors with the aim of multiplying it, they have their differences. Here are the main differences between the two:

- Accessibility: Hedge funds aren’t as available to the average investor as mutual funds. For instance, some hedge funds require investors to have $1 million in net worth. This is quite high compared to mutual funds which have a $100 minimum initial investment.

- Regulation: Mutual funds are highly regulated by the SEC, but that’s not essentially the case for hedge funds which are loosely regulated.

- Transparency: Mutual funds must annually publish their balance sheets/annual reports as well as the quarterly performance of their assets. Hedge funds, on the other hand, don’t disclose this information to the public but only provide it to their investors.

- Redemption: It is relatively easier to redeem mutual funds since they are relatively less. Hedge funds have a lock-in period (typically 3 years) which makes redemption of funds difficult.

The greatest advantage of investing in hedge funds is the ability to earn steady returns that exceed inflation and minimize market risk. The average investor will not have a large net worth nor meet the minimum investment requirements of hedge funds.

A broad portfolio of mutual funds and exchange-traded funds (ETFs) is better than hedge funds for most investors. Mutual funds are more affordable and accessible than hedge funds, and their long-term returns may be greater or equal to those of hedge funds.

Table 1 – Best investment platforms

| logo | Broker | EconAlert Rating | Fees | Account Minimum | Visit Website |

|---|---|---|---|---|---|

| Saxo Bank | 5 | $0 | $0 | learn more |

| Interactive Brokers | 5 | $0 | $0 | Learn more |

| E* Trade | 4.8 | $0 | $0 | Learn more |

| TD Ameritrade | 4.8 | $0 | $0 | Learn more | |

| Charles Schwab | 4.7 | $0 | $0 | Learn more |

The Bottom Line

If you are an accredited investor and would like to invest with hedge funds, then you should think about the fees, investment risk and the value that hedge funds could bring to your overall investment strategy.

Hedge funds may increase returns. However, investors should balance risk and reward.