In mutual fund investors, shares in companies whose business involves buying shares or bonds from other companies. Although mutual fund investors do not directly own stock in the companies they purchase, they share equally in the profits and losses of all fund holdings. This is why mutual funds are called “mutual”.

In this article, we are going to discuss the following topics:

- What are mutual funds?

- Mutual fund types

- How many mutual funds should I have?

What are mutual funds?

Mutual funds are investments that pool money from investors to buy stocks, bonds, and other assets. Mutual funds aim to provide a more diverse portfolio than an average investor can on their own. Professional fund managers can buy your securities on behalf of mutual funds.

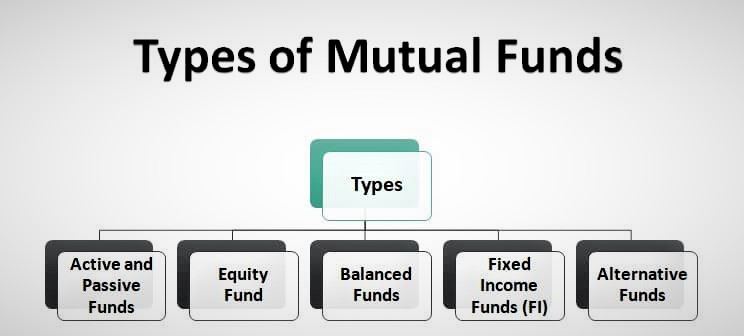

Mutual fund types

Each mutual fund is designed for spreading risk and capturing more significant market gains. Certain types of mutual funds have a higher risk than others but offer greater potential rewards. This is a detailed overview of the most popular mutual funds.

Active and Passive Funds

First, the type of mutual fund being classified is determined by whether it is active or passive. The investment methods used by both funds differ in the way the manager invests money and generates returns for account holders. Active funds aim to exceed a benchmark they have set, such as the S&P 500 and BSE Sensex. Active funds purchase and sell stocks. Managers pay attention to trends, economy, politics, and other factors in order to achieve this. He also studies stock-specific factors such as ratio analysis, earnings growth, and cash flow available for shareholders.

Passive funds, on the other hand, try to replicate the holdings of an index to generate similar returns. Managers buy index stocks and apply the exact weighting. This is not an attempt to beat the index but to stay close to it. Index funds are less expensive than active funds because they require less research and other operational tasks.

Equity Funds

Equity mutual funds purchase stocks from a variety of publicly traded companies. According to the Investment Company Institute, 55% of mutual funds are equity funds. Equity funds offer more significant potential for growth but also have higher volatility. Financial planners recommend that equity funds be included in your portfolio. They have tremendous potential for growth and offer more flexibility to deal with market fluctuations.

The goals of equity mutual funds can be cut and diced in many ways.

- Funds are based on the company’s size

- Funds for industry or sectors

- Value and growth funds

- Funds for emerging, global, and international markets

Balanced Funds

These funds are also known as asset allocation funds. They combine equity and fixed-income funds and have a fixed proportion of investments, such as 60% stocks or 40% bonds. Target-date funds are the most well-known type of these funds. They automatically change the allocation of assets from bonds to equities as you near retirement.

Bond Funds

Fixed-income mutual funds that are most commonly used are bond funds. Investors are paid a fixed amount on their initial investment. According to the ICI, bond funds account for approximately one in five mutual funds.

Bond funds are not designed to buy stocks. They invest in corporate and government debt. Bond funds are considered safer investments than stocks and offer less growth potential than equity funds.

Alternative Funds

These mutual funds are non-conventional investments vehicles and not like stocks or bonds. Institutional and high net worth investors

This MF type is used most often. These funds are complex and not recommended for individual investors. Alternative Investments funds invest in commodities and futures, derivatives, real estate, and hedge funds.

Money market Funds

Fixed-income mutual funds, called money market mutual funds, invest in short-term, high-quality debt from banks, governments, and corporations. These funds can hold U.S. Treasurys and certificates of deposit, as well as commercial paper. According to the ICI, they are among the most secure investments and account for 15% of the mutual funds market.

How many mutual funds should I have?

Many factors will determine the correct number of mutual fund funds for you. These include your investment objectives and risk tolerance. There are some strategic principles to diversify your portfolio if you’re unsure how many mutual funds you should consist of.

The Basics of Diversification with Mutual Funds

Diversification using mutual funds refers to the spreading of money across multiple investments.

Diversification is a way to diversify your risk. It’s reflected in the sage saying, “Don’t put all your eggs into the same basket”.

Investors make the biggest mistake when diversifying: They believe that they can achieve diversification if their money is spread across multiple mutual funds. To put it another way, diversification is not possible if all your money goes into one investment. Diversification is not achieved if your eggs are in different baskets with almost the same characteristics.

Diversification across Asset Classes

Although it might sound appealing to have a portfolio that is only invested in stocks or heavily weighted in them, there are risks. Stocks can appreciate dramatically during economic booms, and you may reap higher returns. However, if you invest too much in cash or take too little risk with your portfolio, it may not generate enough returns to meet your goals. It’s dangerous because your portfolio could suffer large losses in its stock section and significant decreases in its overall value if the market falls.

- Time horizon

- Risk tolerance

- Investment goal

- Asset Diversification

Your portfolio may contain several funds, but if any of them have similar or identical holdings, it is known as fund overlap.

Avoid this error by choosing mutual funds that have holdings in different asset types to avoid it. A simple four-fund allocation could, for example, include one large-cap stock, one small-cap, and one bond fund.

Spread your money among different asset classes to balance risk and reward.4 These critical criteria should be considered when choosing a spread:

Diversification is critical when you decide how many mutual funds or which funds to have in your portfolio. Diversification should be at two levels.

There is no one correct number of funds you should keep in your 401(k), or any other portfolio for long-term investment. A good number of assets will not only ensure diversification but also factor in your investment strategy.

A single fund is a good option if you are looking for a low-effort investment. You can increase the number and complexity of your portfolio by choosing eight funds if you’re willing to do more administrative work. You can probably put together a portfolio that suits your needs, no matter how many funds are settled on.

- One fund: You can invest in one fund and still be diversified.

- Two funds: The increasing popularity of two-fund portfolios combining a stock and bond fund can allow for greater diversification.

- Four funds: A four fund allocation could include a domestic fund, a domestic bonds fund, an international bond fund, and an international stock fund.

- Eight funds: Choose from large, medium, and small domestic stocks funds, emerging market, and international stock funds, as well as two bond funds and a money fund to create a more complicated eight-fund portfolio.