Outstanding shares of a company represent the total number of equities that are traded on the financial markets.

Outstanding shares include also equities owned by the firms directors, officers and employees. Owners of equities, especially of large corporations, can be also sovereign, pension and mutual funds.

In this article, we are going to discuss the following topics:

• What are outstanding shares?

• How do outstanding shares work?

• Different types of shares

Finally, we end with a thought about what all this means to individual investors.

What are outstanding shares?

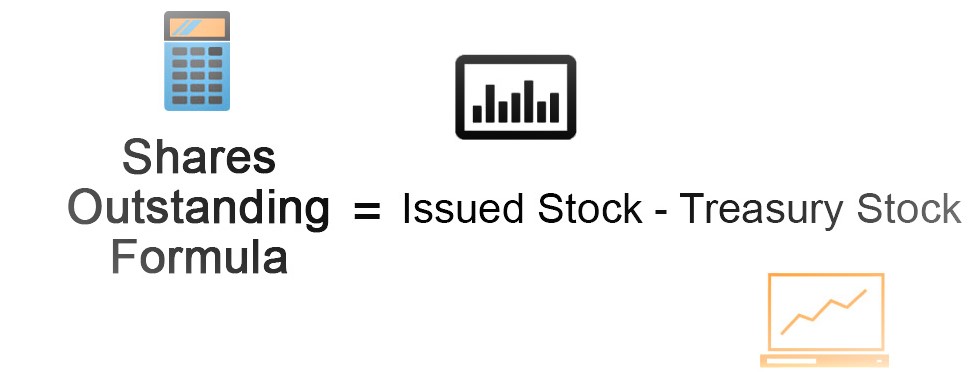

The number of shares outstanding equals the number of equities issued less the number held in the company’s Treasury.

Over time, the number of shares outstanding can fluctuate . If a company sells more shares, splits its stock, or employees redeem stock options, the number of shares outstanding increases.

If the company purchases back shares or completes a reverse stock split, the number of shares outstanding will decrease.

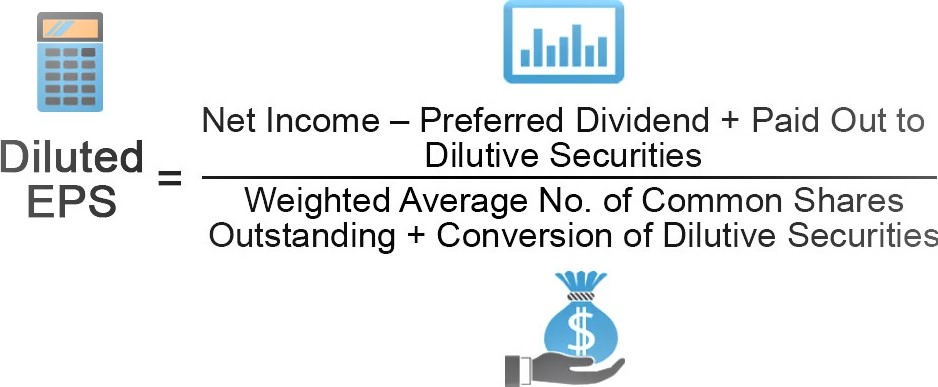

It is important to note that the company’s primary number of shares outstanding can be different from its diluted issued equities.

The direct number refers to the current number of shares outstanding.

However, the fully diluted number represents the share equivalent of any warrants, capital notes or convertible stock that the company may have issued. If all equity instruments were converted to common stock, the fully diluted number indicates the potential number of outstanding shares.

How Outstanding Shares Work?

A balance sheet or quarterly report is a public report that lists the total outstanding shares. These reports are often found on an investor relations page.

What is the importance of total shares outstanding?

First, a company’s market capitalization is calculated by multiplying one share’s current market price by the number of shares outstanding. Market capitalization helps investors compare the size of companies and allows them to evaluate potential growth.

The number of outstanding shares is used to calculate many commonly used financial metrics.

Market capitalization is the sum of share price and number of shares outstanding, and EPS both use the number of outstanding shares to calculate market capitalization.

It is important to recognize that the number of shares outstanding in a company can fluctuate.

Fast-growing technology companies are likely to notice a significant difference in the number of exceptional and fully diluted shares.

These companies use convertible debt to fund their growth and pay employees stock incentives. Many stalwart older companies will have more shares than their shares fully diluted.

Different types of shares

Basic and Diluted Shares Outstanding

You can compute the number of shares outstanding in two ways. The current share count on the secondary market is the basic number of shares.

However, the fully diluted shares outstanding calculation includes diluting securities like convertibles (options, warrants, preferred shares, etc.).

Shares Outstanding vs. Treasury Shares

Outstanding shares of stock can be bought or sold on the secondary markets, but treasury shares (or shares that the company holds) are not available for purchase on the open market. The sum of all outstanding shares and treasury share is the total number of shares issued.

Outstanding Shares vs. Float

The stock’s total shares outstanding determines its liquidity. This is how quickly shares can be bought and sold without having a significant impact on the stock’s price. It is also known as the company’s float, which is the number of shares that a company has openly available for trading on the open market.

The stock’s float is calculated by subtracting the number of shares held by one party (e.g., the founder) from the total outstanding shares.

Authorized Shares vs. Shares Outstanding

The maximum number of shares that a company can issue is called authorized shares. An initial public offering may allow a company to issue 5 million shares, but it can only sell 4,000,000 shares. The authorized number of shares must be equal or greater than the outstanding shares.

shares authorized = shares issued + shares unissued

What does it mean for individual investors?

Smart investment decisions are made by knowing the type of shares and the number of outstanding shares.

Intelligent investors must know how to determine a company’s market capitalization as well as its earnings per share. You need to know the number of those shares if you want to get there.