Physical and Synthetic ETFs

ETFs, also known as exchange traded funds (ETFs), are an efficient way to gain access to a wide range of investment exposures.

Traditional ETFs were investing directly in the assets-constituents of the benchmark they wanted to track.

These ETFs are called physical ETFs.

In the last decade due to their increased demand new types of ETFs were developed.

Synthetic ETF or swap-ETFs is one of these new innovations.

In this article we are going to discuss the pros and cons of investing in synthetic ETFs.

Definition of Synthetic ETFs or Swap-based ETFs

Synthetic ETFs were first introduced in Europe after the global financial crisis of 2001.

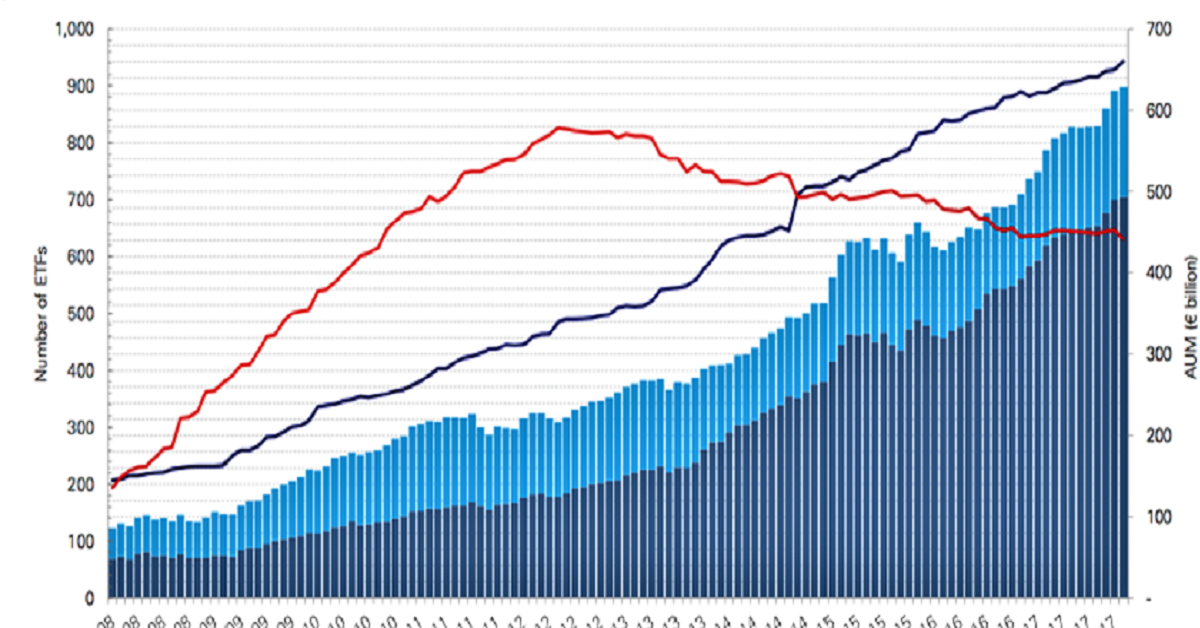

Historical Composition by ETF structure – I ETFs I Europe

During that time investors were looking for investment safety through global diversification, and ETFs were the vehicle to achieve it.

As we mentioned above a physical ETF invests directly in all assets included in the benchmark it wants to track. For example the Vanguard S&P 500 invests directly in the shares of all 500 companies included in the S&P 500 index.

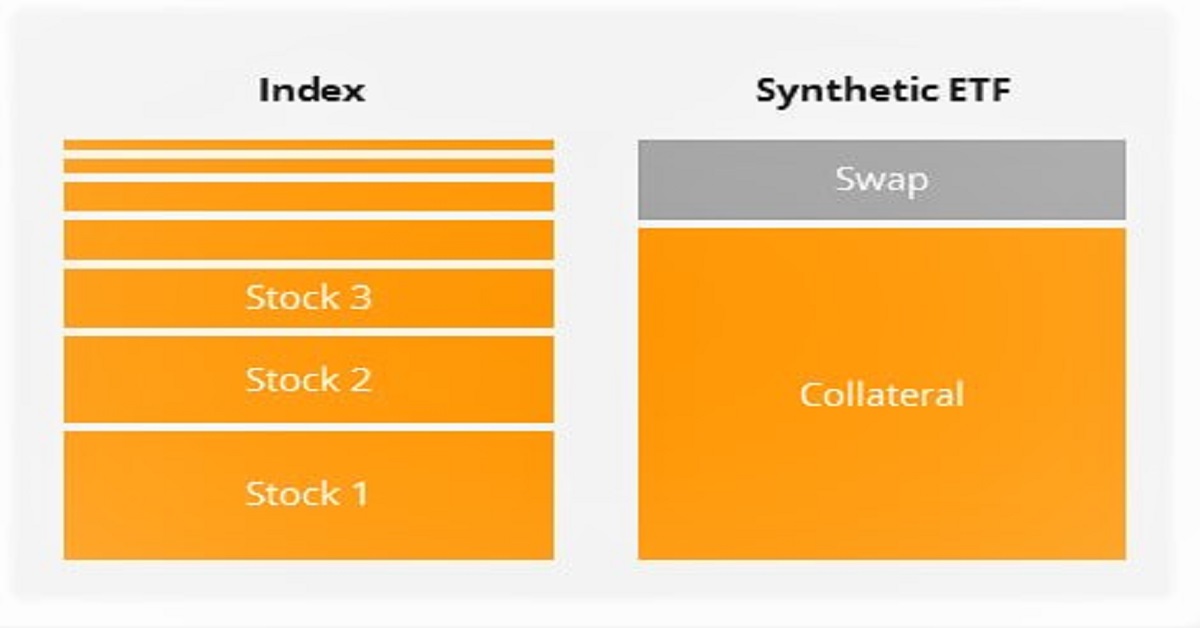

Synethic ETFs, on the other hand, do not hold the underlying assets or securities, but use various techniques to replicated the behaviour of the index.

The most popular strategy is the acquisition of derivatives, called swaps. This is reason why the terms synthetics ETFs and swap ETFs are interchangeable.

To function the “swap method” requires two parties, the ETF issuer and a bank. These two entities often belong to the same parent company (e.g. JP Morgan – the bank, JP Morgan Asset Management – the ETF issuer).

The question now is what the two parties swap (or exchange)?

Let’s consider an example. The Lyxor MSCI Word UCITS ETF that aims to mimick the performance of the MSCI World Index. The index includes 1600 consituents from 25 Developed Markets.

It would be extremely costly and time-consuming for an ETF to trade assets continuously to track as accurately as possible the performance of the index. In essence, the only way for the ETF to track accurately the performance of an index is to have exactly the same weights.

The Lyxor MSCI Word UCITS ETF instead of acquiring all these stocks it creates a “mini” representative portfolio of few of these shares.

In the case of our fund the representative portfolio includes 55 companies (instead of 1600) located in 7 countries (instead of 25)!

But how is it possible to track the performance of an index with 100 more shares? Here comes the bank.

The bank trough a swap agreement agress to pay the any deviation of the performance of the “mini” representative portfolio from the performance of the index. This deviation is called tracking error.

For example let’s say that initially both the MSCI World Index and the Lyxor ETF worth 1000 dollar. In case, the “mini” porfolio increases to 1100 dollar and the index to 1250 dollar, then the bank agrees to “swap” additional performances. Practically, the Lyxor ETF gives to the bank the performance of 100 euro and the bank gives to Lyxor ETF the performance of 250 euro.

Finally, it is important to mention that synthetic ETF are registered in stock markets and can be traded as stocks similar to physical ETFs.

Synthetic vs Physical ETF

| Table 1 | Traditional or Physical ETFs | Synthetic or Swap ETFs |

|---|---|---|

| Assets under management | Index constituents | Swaps contracts and Collateral contracts |

| Transparency | Extremely transparent | Lower than that of physical ETFs. It mainly depends from the ETF provider and the financial institution. |

| Counterparty Risk | Extremely limited | Much higher than that of traditional ETFs. |

| Asset – related costs | Transactions Costs | Swap Costs. |

| Fund Fees | Mangement Fees | Management Fees. |

Synthetic ETF and Collateral

As we mentioned above, synthetic ETFs sign swap agreements with financial institutions (mainly banks) that promise to pay the return of the benchmark index in case the return of the “mini” representative portfolio is lower.

Effectively, the returns of the ETF depend on the ability of the financial institution to pay this excessive performance of the tracking error. The failure of the financial institution to respect its commitment is called “counterparty risk”.

Nevertheless, regulators protect the investors by introducing legislation restricting the effect of the counterparty risk.

For example, according to Europe’s UCITS directives an ETF’s exposure must not exceed 10% of the value of its total assets.

Synthetic ETFs provided by large issuers have an additional layer of protection. Collateralization of the swap agreements.

In many countries, especially those included in the EU, regulators require from the financial institutions to post collateral to reduce the “counterparty risk”. Practically, this means that in the unlikely case of bankruptcy the ETF will have a share from this collateral, hedging investors interests.

Potential investors should always examine whether their ETF cooperates with an institution that provides collateral and what amount is that collateral.

In addition, synthetic ETFs to attract the attention of investors try to reduce the performance fees (on-going charges) and the deviation from the performance of the benchmark index.

Historical data show that synthetic ETFs have a higher success rate at tracking the benchmark indexes than traditional funds.

Synthetic ETFs also have a lower accumulative expense ratio (TER).

Finally, physical ETF has higher transaction costs than swap ETF. The latter do not rebalance so often and not often perform transactions.

The bottom line

Synethetic ETFs are excellent diversification tools with extremely low cost.

The fact that these ETFs can involve counterparty risk must not be overlooked.

Therefore, the reward must be sufficient to offset the risks

Table 2 – Best Investment platforms

| logo | Broker | EconAlert Rating | Fees | Account Minimum | Visit Website |

|---|---|---|---|---|---|

| Saxo Bank | 5 | $0 | $0 | Learn More |

| Interactive Brokers | 5 | $0 | $0 | Learn More |

| E* Trade | 4.8 | $0 | $0 | Learn More |

| TD Ameritrade | 4.8 | $0 | $0 | Learn More | |

| Charles Schwab | 4.7 | $0 | $0 | Learn More |