Why invest in gold?

From the time of Roman Empire to the French Revolution, gold has been the world’s major medium of exchange.

Today, after the collapse of the Bretton Woods System and the gold standard, investors acquire gold mainly as an insurance against political instability and inflation.

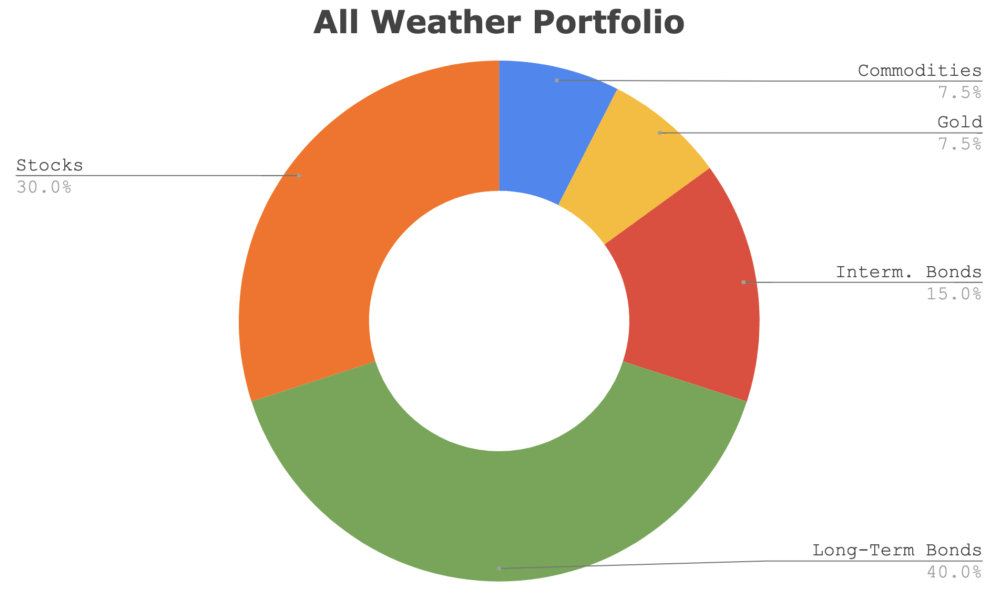

In addition, many prominent investors (such as Ray Dalio, John Bogle, Burton Malkiel) advocate a portfolio allocation in commodities, including gold (even as high as 15% on total assets), in order to reduce overall portfolio systematic risk.

In this article we are going to answer the question how to invest in gold.

The top 6 gold investment strategies we are going to examine are the following:

- Gold Bullions

- Gold Coins

- Jewelry

- Gold miner stocks

- Gold ETFs & mutual funds

- Gold futures & options

You can review each of these strategies to identify which one matches best your own personal risk tolerance and investment aims.

Investing in Physical Gold.

If you are accustomed to online trading, investing in physical gold may be a real challenge, since you are required to interact with dealers outside of traditional brokerages, and you will probably need to pay annual fees for storage and insurance.

Gold bars, golden coins and jewelry are the three main options of investing in physical gold.

Gold Bullions

When thinking about investing in gold, most people imagine a bank vault packed with gold bullion.

This is not far from reality since governments and the majority of HNWI prefer to hold gold bullions rather than investing in financial instruments related with gold.

Gold bullion comes in bars of up to 400 ounces, of which the most commonly available are 1- and 10-ounce bars. Unfortunately, unlike stocks and ETFs, there is not an option to get a fractional share of a gold bar (e.g. ¼ ounch). So, having in mind that the price of gold in the nearest future will probably exceed 2,500 dollar many low- and average-income investors are actually excluded from this investment option.

Nevertheless, for those who can afford it, it should be a priority to use a reputable dealer and to pay for delivery—with insurance—or to shell out for storage at a safe deposit box or a large vault. Unfortunately, this option is limited in few advanced countries such as USA, UK, Western Europe, and Russia.

Gold Coins

Despite the collapse of the gold standard system in 1974, huge quantities of gold coins have been constantly issued by central banks of advanced countries around the world. These coins are commonly bought by investors from dealers at a premium ranging from 5% – 10%.

Usually gold coins weight ¼, ½, 1 or 2 ounces. Collectible coins, such as American Gold Eagles, Canadian Maple Leafs and South African Krugerrands are the most popular among international investors. There is also a significant demand for damaged or worn coins, sold with discount.

Investors should bear in mind that there is not absolute positive correlation between gold coin prices and the price of gold. High demand collectible coins usually trade at a premium. For example, in mid-September 2020, the retail price of a one-ounce American Gold Eagle coin was trading just over $2,000 – almost a 7% markup over a comparable amount of gold bullion.

Investors may be able to find better deals on gold coins from small pawn shops or local collectors, but it’s still much safer to make purchases using licensed dealers.

Gold Jewelry

Another way to invest in physical gold is to buy jewellery. However, there are many risks associated with investing in jewelry as opposed to investing in pure gold.

It is crucial to buy investment jewelry from a reputable dealers and jewellery shops in the first place.

You should always receive certificates verifying the authenticity and the characteristics of the metals, precious stones and jewelry brand, since when you resell it, you will have to hand them over to the new buyer.

Secondly, you should have in mind that you will pay a markup for the design and manufacture costs of the jewellery, which range from 20% – 40% on the raw value of the precious metal.

Finally, you should also be aware of the jewel’s purity. The purity of gold is calculated based on karats, with 24 karats being 100% gold (there are countries such as Russia which are using different metric system to calculate purity). Lower purity decreases the jewel’s melt value, or the raw value of the jewel’s components if it were melted into pure gold.

Investing in gold financial assets

Investing is physical gold is just one way to answer to the question of how to invest in gold.

Financial instruments such as stocks, ETFs, mutual funds are proved to be more effective way to gain exposure to the precious metal.

Gold Miners Stocks

At the end of the 2020 Warren Buffet, the legendary owner of Berkshire Hathaway, gave a signal of an impending financial crisis by investing in large gold miners.

This actions surprised Wall Street since the Oracle of Omaha in numerous occasions admitted that he avoids investing in gold due to its limited potentials.

As it can be logically inferred, companies that specialize in mining and refining gold profit from booming gold prices.

Investing in mining firms is the best way to invest in gold according to professional investors, since it carries slightly lower risk than investing directly in physical gold.

The gold mining giants carry out extensive operations across the globe; therefore, business fundamentals, such as management and R&D, common to many other S&P500 companies, have a significant contribution into their success.

As it was successfully quoted in the movie Wall Street (1987) «Stick to the fundamentals. That’s how IBM and Hilton were built».

Therefore, mining companies can still show a profit in times of even declining gold prices. One way they do this is by hedging against a reduction in the price of gold as a normal part of their business.

For this reason, gold mining companies probably provide a less risky way of how to invest in gold.

On the other hand, the research into and picking of individual companies requires due diligence on the investor’s part and extensive fundamental and technical analysis.

As this is a time-consuming process, it may not be feasible for many individual investors, who prefer a more passive approach in investing.

Just to mention few of the most popular stocks that you can easily trade through online investment platforms:

- Glencore PLC (GLNCY) is an international commodity trading and mining company based in Switzerland. It produces various metals, energy, mineral and a large range of agricultural commodities. The company serves the steel, automotive, battery manufacturing, power generation and oil sectors globally.

- Newmont Corp. (NEM). Headquartered in Colorado, Newmont is the largest gold miner in the world. Its mines operate in North and South America, and in many countries of the African continent.

- Barrick Gold Corp. (GOLD). Barrick Gold is reputable mining company headquartered in Toronto with operation in 13 countries.

- BHP Group Ltd. (BHP) is an international resources company based in Australia. It explores and mines various minerals, including iron ore ,coal, titanium, gold, platinum, silver, ferroalloys, nickel, and copper properties. It is also satisfyingly diversified since it also offers petroleum exploration, production, and refining services.

- Franco-Nevada Corp. (FNV) is an unusual case of gold company since it does not own any gold mines. The company buys the rights to royalties from other gold miners instead.

If you are interested on how to invest in gold stocks you can visit the help center of Interactive Brokers.

Gold ETFs and Mutual Funds

Perhaps the easiest and most secure way to invest in gold is through the acquisition of diversified financial instruments called investment funds.

The main types of investment funds provided on investment platforms are mutual funds, UCITs, ETFs, ETCs, Investment Units and Index Funds.

Regardless of its name an investment fund is a well-regulated entity made up of a pool of money collected from many investors to invest in various financial securities (e.g. bonds, shares, commodities etc.).

In case of gold investment funds, they mainly invest either in actual gold (i.e. bullions, coins), gold mining companies stocks, gold future contracts, debt notes etc.

Choosing between gold investment funds can be extremely challenging and requires also extensive analysis. Nevertheless, investors should understand the main difference between the two most popular types, mutual funds and ETFs.

Mutual funds are actively managed, i.e. they continuously sell and buy assets within the fund in an attempt to beat the market (according to Harvard Report only 20% achieve this during one calendar year and only 5% consistently in a ten year period).

ETFs are passively managed, as they typically track a specific market index or a commodity’s price. For investors who value diversification and low management fees ETFs are the best way to invest in gold.

Nevertheless, ETFs is also a broad category of funds with an extraordinary pluralism of investment approaches.

- SPDR Gold Shares ETF (GLD) holds physical gold and deposit receipts, consequently its price reflects the price of physical bullion.

- VanEck Vectors Gold Miners ETF (GDX) tracks an underlying basket of stocks of gold mining and refining companies.

- Xetra-Gold (EUR) is an Exchange Traded Commodity (4GLD). One single certificate grants the investor the right to demand the delivery of one gram of gold from the issues. The physical gold is held in an allocated vault with the custodian. It does not have any ongoing fees.

If you are interested on how to invest in gold through ETFs check out the following providers

| Logo | Broker | EconAlert Rating | Fees | Account Minimum | Vist Website |

| Saxo Bank | 5 | $0 | $0 | Learn More |

| Interactive Brokers | 5 | $0 | $0 | Learn More |

| E*Trade | 4.8 | $0 | $0 | Learn More |

| TD Ameritrade | 4.8 | $0 | $0 | Learn More | |

| J.P. Morgan W. M. | 4.7 | $0 | $0 | Learn More |

Gold Futures and Options

Trading futures or options contracts is the riskiest way to invest in gold, since the value of these derivatives is based entirely on the price of an underlying asset.

A futures contract is an agreement to buy or sell the underlying security at a specific price at a future date regardless of the current market conditions. Whereas an options contract gives the option to buy or sell the underlying security if it reaches a certain price on or before a certain date.

Investing in futures or options requires opening an account with an online broker. Usually, when you sign up you are required to answer multiple questions in order to determine your investment proficiency and you will be required to sign an acknowledgement of the risk of investing in these derivatives.

After opening a brokerage account for trading futures or options you will be able to buy and sell them using the platform. In most cases you will be charged a commission for your options and futures trades depending on the number of contracts you buy or sell.

If you invest in gold options or futures, you need to monitor your holdings actively to be able to sell, rollover or exercise the options before they expire worthless. There is also a pretty frightening degree of leverage which might lead to huge losses when is not used with prudency.

Shortly, if you don’t hold a PhD in Finance, if you are not a CFA and if you don’t have 10 years’ experience as a trader in reputable stock exchanges avoid them like the plague.

Trading in derivatives is not the best way to invest in gold for you!

Should I invest in gold?

Investing in gold can provide you with a strong tool of diversification and a reliable shield against inflation.

The sudden interest in investing in bitcoin rekindled the discussion whether gold is the optimal way to hedge against an imminent stock market collapse.

Whether to invest in physical gold, gold stocks, gold ETFs and mutual funds or derivatives depends on your own preference and aptitude for risk. Whatever you choose it is not recommended to allocate more than 15% of your portfolio to it.

Risk is present in all investments, including gold. But it takes a long time to learn the highly idiosyncratic gold market, which isn’t forgiving. That is why gold ETFs and mutual funds are the safest choice, adding the gold’s stability and sparkle to your portfolio.

Now that you know how to invest in gold start searching for a reputable investment platform or a professional licensed broker.

References

- MONEY – Master the Game: 7 simple steps to Financial Freedom – Robbins, Tony, 2017

- Guide to Investing in Gold and Silver: Protect Your Financial Future – Michael Maloney, 2008