The Age of Hype and Speculation

After many centuries historians might refer to this period as the Age of Hype and Speculation. Some financial assets connected with cryptocurrencies are experiencing an exponential rise in value.

NFTs (also known as non-fungible tokens) are the most prominent one of them.

Although it is extremely difficult to understand their structure and economic nature, NFTs have lured to investors into an unprecedented volume of trading leading their valuations to the sky.

Is it possible to make money with NFTs?

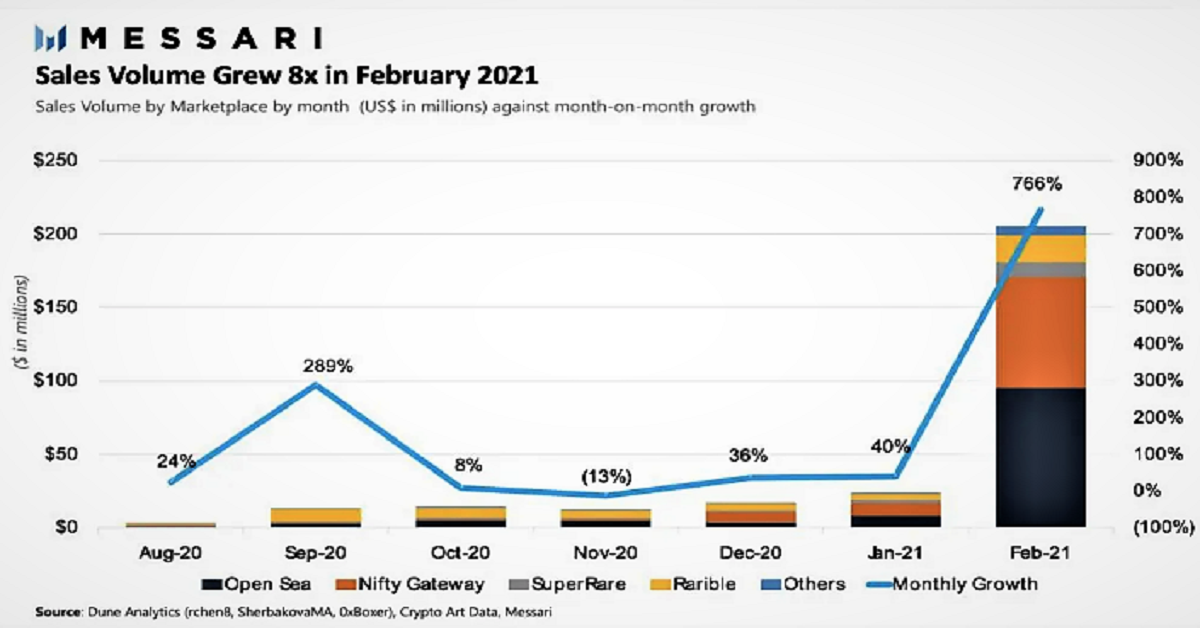

In the graph below you can see that NFT demand has increased significantly between 2020 and 2021.

Obviously, with the correct timing, a little bit of lack and the correct research you can earn a handsome return from NFTs.

In this article we are going to discuss how to invest in NFT by examining the following topics:

• What is a NFT?

• Where to Buy NFTs – Best NFT Marketplaces

• 4 simple steps of how to Invest in an NFT

What is an NFT?

Understanding the nature of NFTs can be really challenging, especially if you are not familiar with the underlying terminologies of crypto and blockchain technology.

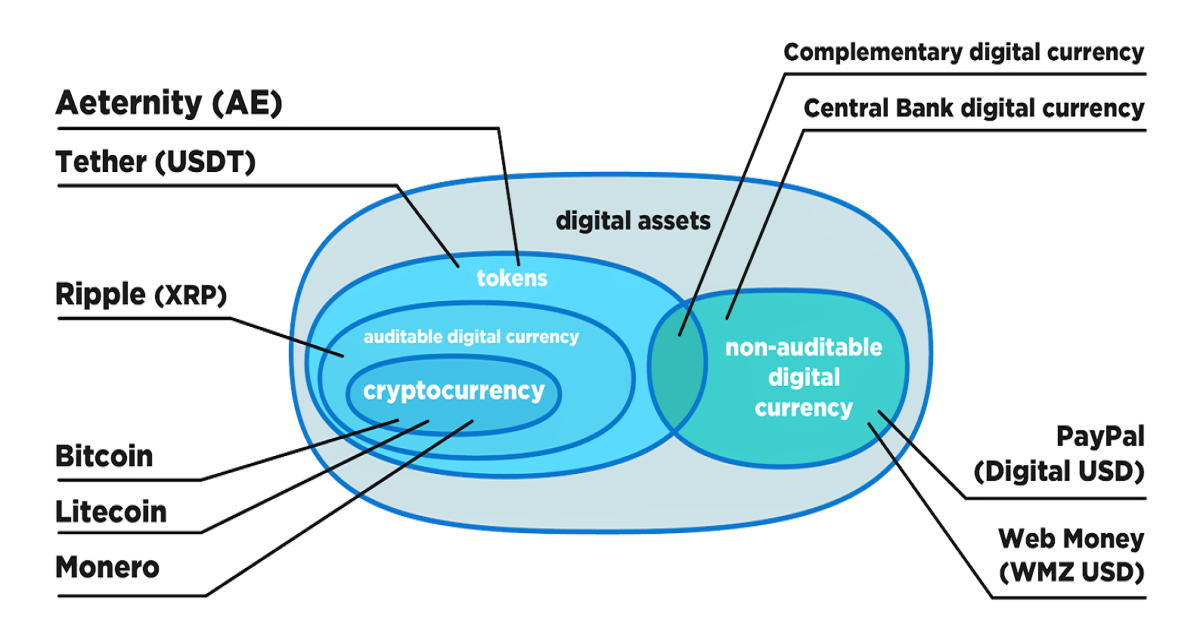

Initially we should mention that both NFTs and cryptocurrencies are digital assets. In the graph below NFTs fall under the category tokens.

In the simplest definition, NFTs are digital assets that represent “non-tangible” but real objects like pictures, music pieces, videos, gifs and video games.

These assets can be acquired online and they can be used in metaverse to decorate your online home or spice up your online parties.

But what distinguishes a NFT picture from a simple jpeg? The short answer is “programming”!

An NFT is a blockchain-based digital asset.

As you might know until now blockchain is a decentralized digital ledger that records transactions. To ensure its security this ledger is fragmented and distributed throughout the internet in a huge network of computers.

NFTs are safely recorded and presented in these ledgers. So, everybody knows who owns what!

To ensure their authenticity through this ledger system, NFTs (as other tokens and cryptos) utilize complex encryption technique. In a sense blockchain is the way to protect NFTs from counterfeiting.

NFTs are created (or encoded) with the same software as many digital currencies. Therefore, to create a NFT it is required not only designer but also a programmer with deep knowledge of blockchain.

NFTs and Cryptos are digital assets.

Nevertheless, they have the following differences:

- Their NFTs cannot be replaced or traded with other NFTs. Each NFT is unique. Do not forget that the word non-fungible in plain English means irreplaceable. On the other hand, cryptos can be exchanged in online markets such as Coinbase and Binance.

- Their mechanical difference is that cryptos are the “native” or “fundamental” assets of a specific blockchain protocol, whereas NFTs are produced by platforms that build on top layers of those blockchains.

Most NFT users use platforms built on the Ethereum blockchain to record transactions. In the following months we are expecting NFTs to be built on platforms of other blockchains such as Cardano.

NFT Marketplaces – Where to Buy NFTs

NFTs can be acquired online through dedicated online “auction houses”, called marketplaces. In essence marketplaces are the Sotheby’s and Christie’s for modern digital art.

The largest and more reliable marketplace is OpenSea, with Rarible the second best choice.

Below is given a table with the largest marketplaces until today (September 2021). Compare their features and fees and decide which is the most suitable for you.

| Table 1. Best Marketplaces | |

| Marketplace | Website |

| OpenSea | Learn More |

| Rarible | Learn More |

| SuperRare | Learn More |

| Foundation | Learn More |

| Atomic Market | Learn More |

| Myth Market | Learn More |

| BakerySwap | Learn More |

| KnowOrigin | Learn More |

| Enjin Marketplace | Learn More |

These platforms enable you to create, sell and buy NFTs

You can buy NFTs either through bidding or through direct acquisitions (exactly as Amazon and eBay).

Most users of these marketplaces use flipping to profit from NFTs. Practically, they are searching for NFTs with high potentials and then try to sell them for a higher price.

NFT is considered a financial asset and must abide by the rules of supply and demand. To hedge against a sharp decline in its value, you can acquire multiple NFTs and not just one.

Exactly as art collectors prefer to acquire multiple paiting rather than one.

It is prudent to create a portfolio of NFT assets.

Now that we epxlained the theory we can guide of how to invest in NFT through 4 simple steps.

How to invest in an NFT – A complete guide

Step 1 – Sign up in a Marketplace account

From Table 1 you should choose the marketplace that fits your requirements.

It is important to mention that a marketplace can be accessed without you having to sign up. As if your touring for free in an art gallery.

If you don’t want to be just a visitor and you aspire to become a collector then you should sign-up. The tricky part is that in a marketplace you do not sign-up with e-mail but with a digital wallet.

Only then you can participate in the marketplace and start wondering how to buy NFT.

Step 2 – Create a crypto wallet

What is a crypto wallet?

A crypto wallet is a software program or device that stores the public and/or private keys of crypto transactions.

Wallets do not store cryptos, just keys!

All cryptos are stored in addresses in the ledgers of blockchain. A public key allows users of blockchain to find you in the network and send you cryptos. A private key enables you to have access to your cryptos.

For most of you, your crypto exchange accounts (e.g. Binance, Coinbase) function as storage for your cryptos. But exchanges are not wallets.

The Best Crypto Exchanges of 2021

| Name | EconAlert Rating | Fees | Account Minimum | Visit Website |

|---|---|---|---|---|

| Binance.US | 4.9 | 0.1% | $0 | Learn more |

| Coinbase | 4.5 | 1.99 | $0 | Learn more |

| Kraken | 4.8 | 0.26% | $0 | Learn more |

| Crypto.com | 4.7 | 0.40% | $0 | Learn more |

| Gemini | 4.5 | 0.35% | $0 | Learn more |

| Gate.io | 4.5 | 0.2% | $0 | Learn more |

| KuCoin | 4.1 | 0.1% | $0 | Learn more |

| Bitstamp | 3.4 | 0.5% | $0 | Learn more |

| Bittrex | 3.3 | 0.75% | $0 | Learn more |

| bitFlyer | 3.3 | 0.1% | $0 | Learn more |

Wallets are separated into two broad categories, hot and cold wallets. Cold wallers which are not connected to the internet and hot wallets which have continuous access to it.

The most effective way to trade NFTs is by creating a hot wallet.

But you must be extremely careful since not all wallets are compatible with all NFTs marketplaces. The most popular marketplace OpenSea works with Ethereum Wallets.

If you own Bitcoins you cannot fund your OpenSea account! You should initially trade your Bitcoins for Ethereum and then send them to the relevant Wallet.

So your wallet should support Ethereum or Ether. The table below presents the largest and most reliable Ethereum Wallets.

| Table 2. Best Ethereum Wallets | |

| Company | Website |

| MetaMask | Learn More |

| Gemini | Learn More |

| Kraken | Learn More |

| Binance | Learn More |

| Trezor | Learn More |

| Coinbase | Learn More |

The best NFT Wallet

EconAlert suggest both OpenSpace and MetaMask Wallet, since they are the largest marketplace and wallet respectively.

In the case of MetaMask you should download the extension on your browser. When creating the wallet you will be given a 12 word phrase. This phrase is effectively your password. In case you want to have an access to your wallet through another browser or the mobile app this is your keyword. The required password is not so important since it is not universal for all devices/browsers.

When you write the 12 word phrase in a new browser always use space between words.

Coinbase Wallet is also a very good option. Bear in mind that in case you have a Coinbase Exchange account, this account cannot function as a wallet. The Coinbase Wallet is a distinct application, that should be downloaded separately.

Step 3 – Fund Your Account

As we mentioned above to participate in the NFT marketplace, you must purchase Ether.

You should enter your Crypto Exchange account and buy Ether either with other cryptos or fiat money.

In the case of Binance you buy Ethereum through the menu categories “Buy Crypto” or “Markets”. After you purhase Ethereum you go to your wallet, you find Ethereum and then choose the option “Withdraw”.

In order to withdraw Ethereum you are asked to write the Recipient’s ETH Address. As you see the word “ETH” is stressed as a reminder that you can send Ethereum exclusively to wallets that support Ethereum blockchain. Then you click on the MetaMask Extension and you copy – paste your Address back to Binance.

Now you are ready to buy yout NFTs.

4. Buy Your NFT

You’ll be ready for purchase once your digital wallet is active and has been funded with cryptocurrency.

Understanding the auction format used by NFT markets is important.

To purchase a token, you will need to place a bid. If you are the highest or only bidder, the sale will proceed.

Which NFTs to buy?

If you get in the most popular marketplaces, you will probably get overwhelmed by the large amount of NFTs available for sale.

How do you make a wise decision in this chaos?

Picking solely on taste it would be a catastrophic way to start your NFT collection.

As in all investment decisions, there are some basic rules that you should follow to find the rising stars.

Let’s use OpenSea’s menu to figure out what makes sense in this chaotic environment.

Most popular designers

Firstly, we click on Stats and rankings to examine the features of the most prominent and profitable NFTs.

The largest and most successful NFT is CryptoPunks. The prominence of this NFT is evident from the large number of owners (>3.2K) and the huge volume of trades (>500K ETH). In the OpenSea page presenting CryptoPunks you can check their twitter account. There you can see the account was created in 2009 and there are more than 70K followers.

Therefore, as a rule of thumb you should go with projects with more than one thousand owners and more than >50K ETH volume of trades. These two indicators can ensure that you are going to find potential owners in case you want to sell in the future.

Also, it is good to consider projects designed by popular creators with long-term presence in the art community.