Introduction to bonds

Bonds play a paramount role in any investment portfolio. They are one of the safest financial instruments, they yield regular passive income, and they can protect your portfolio from bearish markets and economic crises.

In business journalism bonds are also called fixed income securities or debt securities and they are one of the four main asset classes along with equities, certificates of deposits and cash.

Many amateur investors are wondering how to invest in bonds and in which bonds to invest in.

In this article we are presenting the most important aspects of bond investing:

- What is a bond

- Types of Bonds

- How do bonds work? How do they pay coupons?

- Direct investments in bonds

- Why invest in bonds

- What are the risks associated with bonds?

- Bond funds and bond ETFs

- Advantages and Disadvantages of Bond ETFs

As we will see the there two ways of how to invest in bonds.

You can either invest in individual bonds or buy a bond investment fund.

What is a bond?

Bonds are in essence loan agreements between a borrower and a creditor.

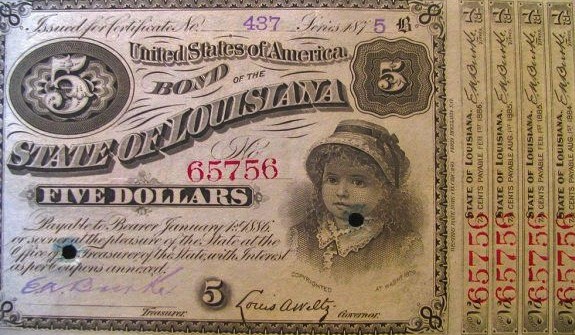

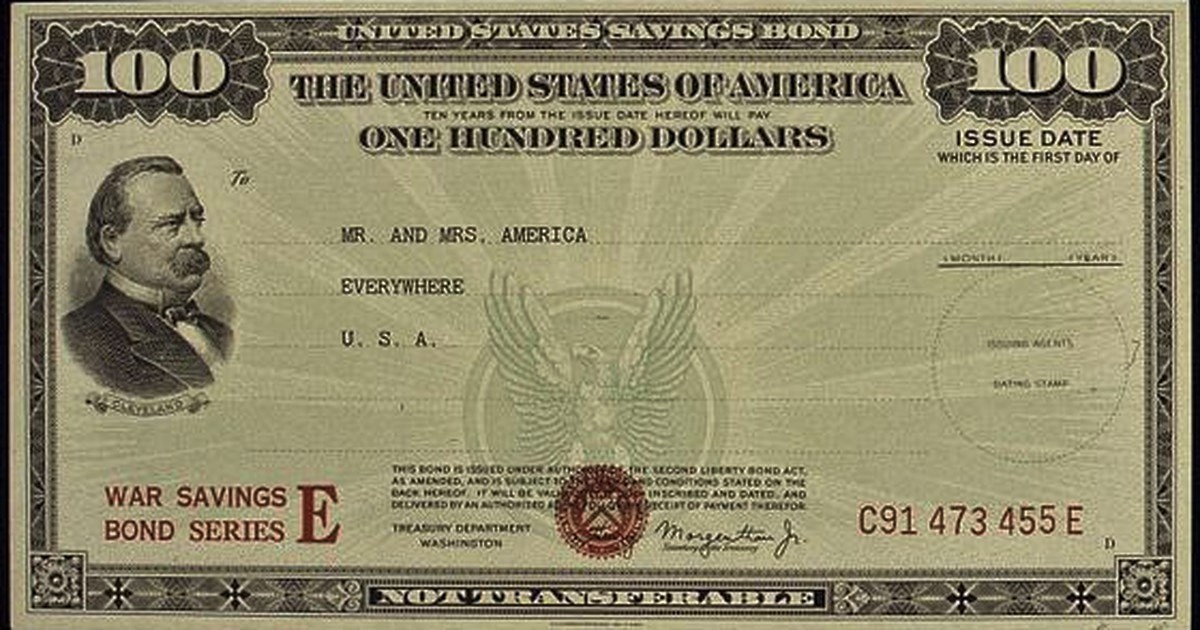

For example, when a government needs to build new hospitals or roads it issues bonds and sell them to the public to finance the construction of these projects.

Large corporations also issue bonds to raise funds for new equipment or to launch a new project.

In return, both government and companies promise to pay back the initial investment with interest (called coupon) over a set period.

The most expensive project in the USA history, the transcontinental railroad connecting New York with San Francisco in 1869, was subsidized exclusively by the issuance of both government and corporate bonds.

Bonds are graded by international credit rating agencies such as Standard & Poor’s, Moody’s, and Fitch Group (Also called the Big Tree).

These agencies rate bonds to different scales (i.e. from AAA to D or from Aaa to C). These scores assess the probability that investors will lose his initial capital or part of it.

Types of Bonds

There are two main categories of bonds:

- Government bonds. The largest issuers of government bonds are the U.S. Treasury, the European Central Bank (ECB) and the Bank of England. In investment platforms such as Saxo Bank by far the most popular bonds are the US government bonds. The three main categories of US bonds are: (a) Treasury Bills (TB), with a year or less to maturity (b) Notes, with a maturity ranging from 1 to 10 years (c) Bonds, with more than 10 years to maturity.

- Corporate bonds. Large corporation prefer to issue bonds rather acquiring a bank credit because bond markets offer lower interest rates and usually more favourable terms. Not all corporate bonds are available on on-line investment platforms.

How do bonds work?

As we explained bonds function as long-term loan agreements not different from a simple bank loan agreement.

The borrower (issuer) issues a bond that specifies the terms of the loan, interest payments, the frequency of these payments, and the time at which the initial investment capital (i.e. the principal) must be paid back (bond’s maturity).

The interest payment (called the coupon) is part of the return that investors earn for lending their funds to the bond issuer. The interest rate that defines the payment is called the coupon rate.

Your roadmap for direct investments in bonds.

Now that you know the basics, we can show you in 7 simple steps how to invest in bonds directly?

- Initially, set your investment aims and understand your risk profile. Decide what percentage of your wealth you want to invest in bonds and in which kind of bonds. In general bonds are safer than stocks but there are junk bonds that are equally risky to equities.

- Understand when your bonds mature. Bond’s maturity is the date when you will receive back your initial investment. In case of bond funds and ETFs you do not have to worry about maturity.

- Know your bonds’ coupon payment schedule. Bonds pay coupons monthly, quarterly, semi-annually, annually, and there are bonds that do not pay coupon at all (zero-coupon bond).

- Track your bond’s rating. A bond’s rating is the main indicator of the bond issuer’s creditworthiness. The lower the rating, the higher the risk the bond will default (i.e. lose all your initial investment). Bonds can also get haircut (i.e. lose part of your investment). Aaa and AAA are the higher ratings according to Moody’s and S&P correspondingly. Bonds with ratings Caa2 (Moody’s) and CCC (S&P) have the higher risk of default or haircut.

- Analyse the fees by carefully reading the prospectus or the information section in the investment platforms. In case you opt to invest through a brokerage company study its fees and commissions

- Learn which macroeconomic factors adversely affect bonds. For example, when interest rates rise bonds price’s decrease, since bank deposits become more appealing. Also, rising inflation compresses bond prices since real estate and commodities become more attractive to investors.

- If you are thinking to invest in corporate bonds read the economic and accounting fundamentals of the issuer. Bonds of companies with solid fundamentals have insignificant possibility to get haircut or default.

Why invest in bonds?

Bonds play a crucial role in the portfolio of all great investors regardless of their investment philosophy and aims. The main benefits of investing in bonds are the following:

- Diversification: According to the legendary fixed-income investor Bill Gross, bonds are considered “safe-havens” in times of uncertainty and economic downturn. In the all-weather-portfolio of Ray Dalio fixed-income securities occupy an impressive share of 55% of the total wealth invested. Empirically, it was proven that bonds counterbalance the investments in equity, commodities and recently cryptocurrency.

- Decrease of risk: Bonds are broadly understood to have lower risk than stocks due to their lower sensitivity to macroeconomic risks and geopolitical events, such as wars, natural disasters, and terrorism.

- Capital preservation: With bonds as with certificates of deposit is extremely rear to lose your initial investment.

- Passive Income: Bonds pay fixed interest with regular frequency. It is an excellent choice for those who desire a passive source of income, more convenient than rental real estate income.

What are the risks associated with bonds?

Before the financial depression of 2008 investors used bonds for long-term strategies to counterbalance equities’ volatility during downturns.

According to the prominent former CEO of PIMCO El-Erian, in the last decade bond market became more opportunistic.

Practically, this means that today there are many investors who are using bonds for speculative purposes to outperform stocks.

The main risks associated with investments in bonds are the following:

- Interest rate risk: For those who did not study economics the way interest rates affect the financial markets might seem puzzling. Nevertheless, explanation is simply straightforward. When bank interest rates rise, certificates of deposit become more appealing than bonds, so the demand for bonds decreases.

- Inflation risk: Inflation is defined as the general increase in the prices of goods and services in an economy in one year. If the inflation rate is higher than the investment rate of bonds (i.e. coupon rate), the investor’s purchasing power is deteriorates.

- Credit or financial risk: This type of risk encompasses the possibility that a bond issuer could default and not honour its debt obligation. This possibility is significantly higher for corporate than for government bonds, since governments rarely do they default. The most recent example of a government unable to honour its debt obligation was Greece in 2012. In the case of Greece bond principles were haircut by more than 25%.

- Liquidity risk: In case of corporate bonds or developing countries’ government bonds there is a possibility during fire-selling periods an investor not being able to sell them due to limited demand. In this case, the investor will be forced to sell his bond with discount.

- Underperformance: Equities are considerably more profitable than bonds. In the period 1929 – 2015 equities averaged a return of 11.5% while bonds returned on average 5.3%. If consider the risk-adjusted returns for the same period equities provided an 8.5% return while bonds 4.3%.

- Lock in period: When you buy a bond, you lock your initial investment until the maturity date. For example, if you acquire a 7-year-bond, you cannot cash in your initial investment for 7 years. You can sell the bond at any time but if the demand is low, you might be forced to sell it with discount and lose part of your capital.

As we consistently mention in our blog diversification and asset allocation are the bulletproof way to use all financial assets, including bonds.

Bonds Funds and Bonds ETFs

But there is also another indirect way that address the issue of how to invest in bonds.

Investment funds.

A bond fund or debt fund is a fund that invests exclusively in bonds according to a predetermined investment strategy.

Based on the investment strategy there are the following types of funds:

- US Government Bond Funds that invest solely in US government bonds of various maturities.

- Investment Grade Corporate Bond Funds that invest in bonds issued by the largest corporations in the world, such as Microsoft, Oracle, Tesla, Pfizer, McDonalds etc.

- High-Yield Bond Mutual Funds investing in US bonds issued by corporations with low credit rating. Some of these funds invest mainly in “junk” bonds, which have the lowest credit rating and consequently the highest possibility for default.

- International Bond Mutual Funds that invest in international government and corporate bonds.

Most individual investors prefer to invest in bond funds rather than investing directly in bonds. Investors who are not familiar with financial markets it is advisable to invest in well diversified bond ETFs which are passively managed, and they have the lowest possible management fees.

Usually, bond ETFs are constructed in a way to mimic the behaviour of a specific bond mark index, these ETFs are called index ETFs.

For example, the iShares 7-10 Year Treasury Bond invests in US Treasury notes expiring 7 – 10 years from now to copy the behaviour of the relevant index.

Index ETFs follow this seemingly unintelligent strategy to cut their management fees and maximize their returns.

In addition, bond ETFs trade daily on centralized exchanges while individual bonds are sold over-the-counter (OTC) by specialized brokers.

In essence, the traditional bonds’ structure makes it extremely difficult for the average investor to find bonds with an appealing price. On the other hands, bond ETFs are a traded in major indexes and you can easily buy them through mainstream investment platforms. Practically, trading bond ETFs is like trading simple stocks.

| Logo | Best Investment Platforms | Econalert Rating | Fees | Account Minimum | Visit the website |

| Saxo Bank | 5 | $0 | $0 | Learn More |

| Interactive Brokers | 5 | $0 | $0 | Learn More |

| SoFi Active Investing | 4.9 | $0 | $0 | Learn More |

| E* Trade | 4.9 | $0 | $0 | Learn More |

| TD Ameritrade | 4.8 | $0 | $0 | Learn More |

Bottom Line – How to invest in bonds?

The answer cannot be straightforward, since each investor has different budget constraints, risk profile and investment aims.

No one can deny that investing directly in bonds has many benefits. You can sell the bond at a higher price in the future and make money from capital appreciation. Also, you receive fixed interest payments on a regular schedule.

Bond ETFs on the other hand provide the same advantages but with few minor differences.

Firstly, bond ETFs invest in bonds with various maturity dates therefore the interest payments are irregular and not fixed.

Practically, bond ETFs’ investment positions are constantly changing since fund managers continually buy and sell bonds to be consistent with their investment strategy. This is a challenging process especially for corporate bond ETFs due to their limited liquidity which might divert the fund from its predetermined investment strategy.

Investment in bond ETFs theoretically is slightly riskier than investing in individual bonds, since ETFs do not give any guarantee that the principal of any of their bonds under management will be repaid in full.

Nevertheless, most of the bond ETFs are well diversified therefore investors who trust them perform better than those who invest directly in bonds