Best way to start investing

Financial markets can be unpredictable and seemingly illogical, making them extremely complex to understand for those considering participating in them.

But those who take the time to learn the fundamental financial and portfolio management principles stand to gain significantly.

Before we even start speaking about investments you should spend some time to set your investment aims according to your needs, risk profile and budget constraints.

Risk profile is your willingness to take risk and your ability to handle the stress it entails. Practically, you should contemplate what potential loss of your wealth will disturb your sleep and harm your health.

If you already did that then we can answer the question of how to start investing by analysing the features of the different types of investments and their position on the investment risk pyramid.

Specifically, the main types of investments according to their risk-return profile are:

- Cash Bank Deposits and Certificates of Deposits

- Bonds

- Stocks

- Mutual Funds

- ETFs

- Commodities & Precious metals

- Real Estate

- Cryptocurrency

- Derivatives

And a small bonus!

At the end of this article, we will reveal the bulletproof investment strategy to triumph over the largest fund managers on the long-term regardless of recessions and economic cycles.

And the best thing, you do not need to enter Harvard or spend endless times in front of incomprehensible charts.

Cash Bank Deposits and Certificates of Deposits

Cash Bank Deposits (CBD) and Certificates of Deposits (CD) are undoubtedly the safest and simplest ways to invest.

Not only they always offer a positive interest rate but also, they guarantee that the investor will not lose his initial capital.

The main difference between CBD and CD is that the first gives to investors the opportunity to liquidate his whole investment at any time without any sanctions, for this reason it offers also lower interest rate.

However, investments in CDs entail also significant risks.

The most important of them are the following:

- The positive interest rate earned from CD is so low that it hardly ever beats inflation. So, your real return is negative.

- Your money is locked for a predetermined period of time (3 months – 2 years) and the investment terms might include withdrawal penalties.

- Interest from CD are usually taxed.

- Finally, one of the cornerstone principles of investing, is that no one, even the “too big to fail” Goldman Sachs, can give you a guarantee that you are not going to lose your deposits. Banks can collapse and governments can bail in by confiscating deposits.

Bonds

A bond is the second most secure financial asset after CBD and CD.

It is the favourite financial instrument of Ray Dalio who advocates that bonds equanimity can balance the explosive temperament of stocks in a correctly diversified portfolio.

Effectively a bond is a loan made by an investor to a borrower in return for fixed payments (called coupons) paid with a predetermined frequency (quarterly, semimanual, annually) and with a set expiration (i.e. maturity date).

At the maturity of the bond, the borrower is obliged to rebuy the bond on a pre-agreed price called the face value. The borrower can be either a government or a corporation.

The higher the credit rating of the government or the corporation the lower the probability of a «haircut» of its bonds current value.

Haircuts of government bonds are extremely rare (Argentina 2000, Greece 2013) while haircuts of corporate bonds are less possible the higher the creditworthiness of the company. Who can imagine Microsoft or Toyota Motor failing?

The profitability of an investment in bonds is defined by four elements its face value, the coupon rate, the coupon dates and its market price.

From these variables only the market price fluctuates.

The three main factors that affect bond prices are the Central Bank interest rate (i.e. monetary policies such as issuing of money), inflation and credit ratings.

Both government and corporate bonds can be easily acquired through investment platforms such as Saxo Bank.

| Logo | Broker | EconAlert Rating | Fees | Account Minimum | Website |

|---|---|---|---|---|---|

| Saxo Bank | 5 | $0 | $0 | Learn More | |

| Interactive Brokers | 5 | $0 | $0 | Learn More |

| E*Trade | 4.8 | $0 | $0 | Learn More |

| TD Ameritrade | 4.8 | $0 | $0 | Learn More | |

| J.P. Morgan W. M. | 4.7 | $0 | $0 | Learn More |

The transaction costs of bonds are significantly higher than those of stocks and ETFs (ranging from $50 – $100 per transaction).

In some cases, the acquisition of government bonds might require a minimum size of investment.

We suggest to new investors to buy bond ETFs than actual bond due to their significantly lower fees.

Stocks

For most investors the question “how to start investing” is identical to the question of “how to start investing in stocks”!

No other investment was such extensively glorified or demonized in our consciousness, in art, in literature, in popular culture and everyday talk.

Stocks (also known as equities and shares) provide the opportunity to investors to participate as minority owners in a company’s success through increases in the equity’s price and ownership bonuses, called dividends.

In case of bankruptcy the holders of equities have a claim on the assets of the company, but they do not own the assets. Practically, in case of bankruptcy shareholders will take nothing.

Despite the colossal research there is no clean equation that tells us precise how the price of a stock will behave.

There is even a great number of academics and professional investors supporting the theory that stock prices evolve according to a random walk and thus it is impossible to predict them.

By repeating a popular finance experiment in 2021 a 6-year-old monkey, became the 22nd most effective fund manager in Wall Street after selecting his stocks by throwing darts at a list of 133 internet companies.

Nevertheless, there are three groups of factors that attempt to decipher the fluctuations of the stock markets: fundamental, technical, and behavioural factors.

Warren Buffet is a fervent adherent of value investing a subdivision of fundamental analysis school, while the perplexing technical analysis is the reason why Wall Street investment companies’ employee more mathematicians and engineers than NASA.

In addition, empirically we can say that the larger the corporation the lower the fluctuations of its stock price.

If you really want to get into in stock investing and you are not willing to enrol in a high-ranked finance department then firstly you should become a bookworm and secondly you should start following the latest business news.

Mutual Funds

An investment fund (or mutual fund) is a type of financial vehicle made up of a pool of money collected from many investors to invest in various securities like equities, bonds, real estate, alternative investments, derivatives etc.

These funds are managed by professional investors, called portfolio managers, who decide in which assets the pooled investment will be allocated.

There are many advantages in investing in mutual funds such as transparency, economies of scale, easy access, professional management, variety, and freedom of choice.

Undoubtedly, above all these benefits stands diversification, which means that with a small amount of money investor can acquire a well-diversified share of hundreds or even thousands of financial assets against a considerably low management fee.

Exchange Traded Funds (ETFs)

Probably the best answer to the question of how to start investing is through ETFs.

The best way to explain ETFs is by contrasting them with their fancy cousins, mutual funds.

Their main similarity is that both types of funds comprise a mixture of different assets and represent a highly effective way for the average investor to diversify.

Their main structural difference is that ETFs are passively managed since they just mimic the behaviour of particular market indices (i.e. S&P Global, MSCI World, S&P Commodity Producers Gold, Global Bond Index etc,) while mutual funds are actively managed.

Active management is the main reason why ETFs have considerably lower fees than those of mutual funds (see table).

| ETFs | Mutual Funds | |

| Transaction Costs | 0.1% (min. €10) per transaction | 0.1% (min. €10) per transaction |

| Custody Fees | 0.25% (min €5) per month | 0.25% (min €5) per month |

| Ongoing Charges | 0.07% – 0.85% | 1.5% – 3% |

| Third party payment costs | 0% | 0.3% – 0.75% |

Commodities and Precious Metals

Investing in commodities is an excellent way for the average investor to hedge his portfolio from market downsides.

The most widely traded commodities are gold, silver, crude oil, natural gas, coffee, wheat, cotton and sugar.

Until recently, trading commodities was not for everyone since it required large minimum investment amounts and enormous expertise.

The easiest and cheapest way to invest in commodities today is through commodity ETFs.

Specifically, there are 4 type of commodity ETFs:

- Exchange-traded notes (ETNs)

- Exchange-traded commodities (ETCs)

- Equity ETFs that invest in commodity-related stocks

- Physically backed funds

- Futures-based funds

There are cons and pros to each of the different types, so investors should analyse their investment goals and risk tolerance profile before choosing one of them.

Real Estate

How to start investing in real estate can be overwhelming for the average investor.

But there are ways to do it easily and correctly!

For many years investing in real estate was a privilege only for few wealthy investors.

With the introduction of REITS and Real Estate ETFs middle income investors can become “co-owners” of prime offices, 5-star hotels, lucrative golf resorts, wellness centres, malls, thematic parks, student dormitories etc.

To be more precise, ETFs do not invest directly in real estate but in corporations called REIT (Real Estate Investment Trusts) that use pooled wealthy investors money to purchase and operate income properties.

Today the Real Estate ETFs with the most valuable assets under management are:

- Vanguard Real Estate Index Fund

- iShares U.S. Real Estate ETF

- Schwab US REIT ETF

- Real Estate Select Sector SPDR Fund

- iShares Cohen & Steers REIT ETF1

Real estate returns usually moves to the same direction with stock returns, but with significantly lower fluctuations.

Furthermore, statistical evidence reveals that old buildings in city centres and touristic zones have per average 25% higher return than luxury and new real estate.

Cryptocurrencies (Cryptos)

Investing in cryptocurrencies is a new investment option.

The most famous cryptocurrency is Bitcoin whose price skyrocketed from $0.30 at the beginning of 2011 in $54,000 in February 2020. All other cryptocurrencies launched after Bitcoin are called Altcoins, the most famous of them are Ethereum, Cardano, Ripple and Stellar.

Cryptocurrency is a digital currency that is protected by advanced cryptography, which makes it impossible to copy or double-spend.

The greatest advantage of cryptos is that they are not issued by a central authority and so they are essentially unaffected of the effort of the any government to control them.

Cryptocurrencies face criticism for many reasons, including their high volatility (i.e. extreme price fluctuations), energy consumption, lack of transparency and their use as a transaction medium for criminal activities (i.e. money laundering, cyber-attacks etc.).

Nevertheless, they have also undoubtable advantages, such as their inflation resistance, decentralized nature, divisibility etc.

Derivatives

Derivatives, such as options, swaps, futures, forwards, CDO are the final in our list.

If you are looking for a concise presentation of their features, the lecture of the famous fictional banker Gordon Gecko in the 2011 movie, Wall Street Money Never Sleeps is on the point:

“They got all these fancy names for trillions of dollars for credit, CDO, CMO, SIV, ABS. You know I honestly think there are only 75 people in the world that knows what they are”

So, if you do not belong to this group of 75 people go to the next point and do not bother even to learn the abbreviations.

All-season portfolio

As we mentioned at the beginning of this article, we would reveal a solid long-term strategy immune to financial crises that would easily win the 80% of the largest investment managers.

In May 2020 in the annual meeting of Berkshire Hathaway, Warren Buffet, reiterated his best financial advice for the average investor: “In my view, people who are living quiet lives far away from the fuss of Wall Street, the best thing to do is to own a stock ETF index fund, such as S&P 500”.

The irony behind this statement is that this legendary investor became one of the wealthiest individuals on our planet by incorporating the most advanced active investment strategies and his best advice for you is to invest in an index fund or an ETF.

Why?

The answer is not so straightforward, but it has to do with economic cycles and the perpetual technological progress.

However, for those who are intrigued to understand the invisible forces running the markets and they are not satisfied with the passiveness of investing on one index fund we would suggest to create a well-diversified portfolio with ETFs before moving to individual stocks, bonds or even alternative investments.

If during this process you do not want to jeopardize your investments, we would suggest an approach suggest by another great investor Ray Dalio, the founder of the world’s largest hedge fund, Bridgewater Associates.

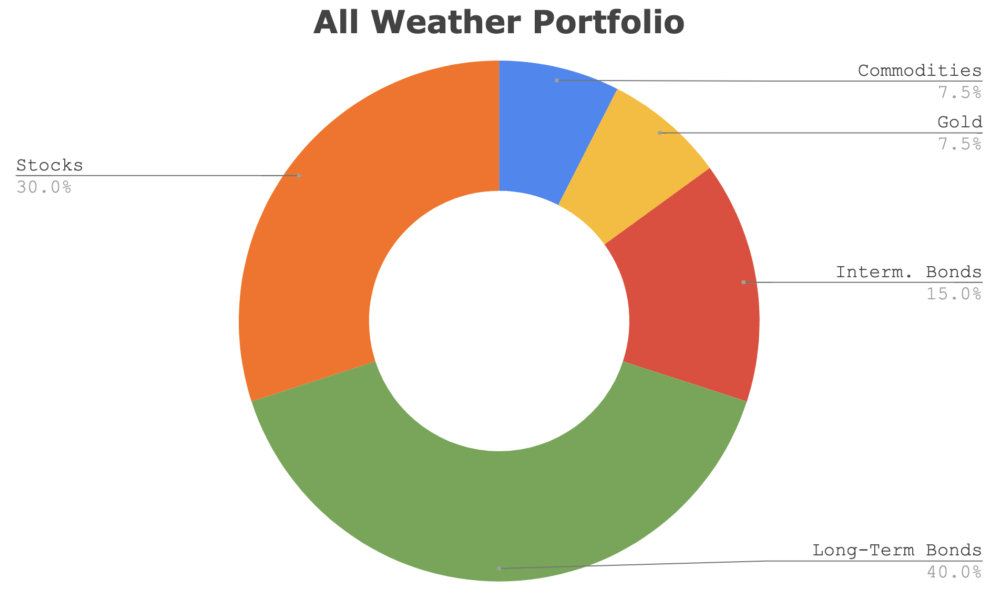

His investment strategy is called All-Season Portfolio and its based on the idea that all investment assets are affected mainly by two variables inflation (or deflation) and economic growth (or recession).

According to Dalio there are only four “economic” seasons:

- Higher than anticipated economic growth.

- Lower than anticipated economic growth.

- Higher than anticipated inflation.

- Lower than anticipated inflation.

Dalio through his analysis detected the mix of asset classes that perform well in each of these different seasons.

Based on his research an all-season portfolio should have the following structure:

- 30% large cap stocks

- 40% long-term bonds

- 15% intermediate-term bonds

- 7.5% commodities

- 7.5% gold

Now we hope that you have a robust foundation to start planning your own investment strategy.

Good luck and do not get greedy!